Monday, July 31, 2017

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, July 28, the S&P 500 closed @ 2472, and that was...

+6.6% ABOVE its 12-Month moving average which stood @ 2319.

+6.0% ABOVE its 40-Week moving average which stood @ 2332.

+1.3% ABOVE its 10-Week moving average which stood @ 2441.

Therefore, the INTERMEDIATE-Term trend is NEUTRAL

and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Monday, July 24, 2017

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, July 21, the S&P 500 closed @ 2473, and that was...

+6.6% ABOVE its 12-Month moving average which stood @ 2319.

+6.4% ABOVE its 40-Week moving average which stood @ 2324.

+1.7% ABOVE its 10-Week moving average which stood @ 2432.

Therefore, the INTERMEDIATE-Term trend is NEUTRAL

and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Monday, July 17, 2017

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, July 14, the S&P 500 closed @ 2459, and that was...

+6.1% ABOVE its 12-Month moving average which stood @ 2317.

+6.2% ABOVE its 40-Week moving average which stood @ 2315.

+1.5% ABOVE its 10-Week moving average which stood @ 2424.

Therefore, the INTERMEDIATE-Term trend is NEUTRAL

and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Thursday, July 13, 2017

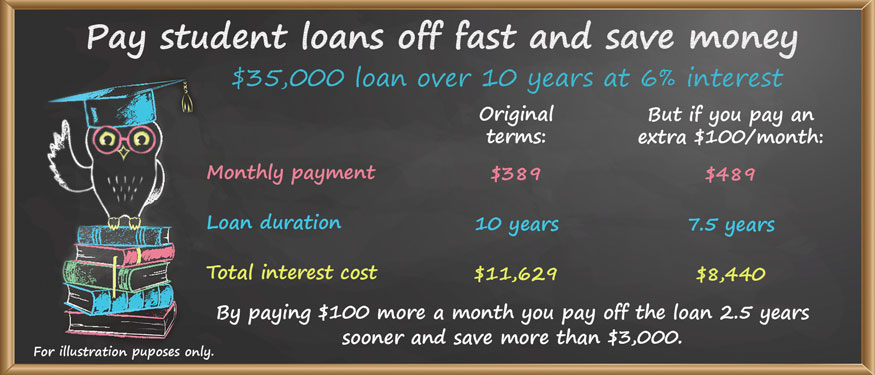

Two Ways to Pay Off Your Debt and Student Loans Quickly

Pay It Back Fast: Make Extra Payments

The most straightforward way to pay off your outstanding debt or student loans faster is by making extra payments each month.

While your regular monthly payments go toward interest and your loan balance, extra payments are credited entirely against your outstanding balance. For example, if your regular payment is $100, $70 may pay interest costs while $30 is credited against your balance. Making an extra payment of $100 would decrease your balance by the full $100.

There’s one consideration, though: Talk to your lender to make sure that extra payments are applied the way you would like—they may not automatically be applied to the balance and instead be credited as prepayment of the next month unless otherwise noted.

There’s one consideration, though: Talk to your lender to make sure that extra payments are applied the way you would like—they may not automatically be applied to the balance and instead be credited as prepayment of the next month unless otherwise noted.

Two Strategies for Extra Payments

Both of these strategies gather momentum as loans are paid off.

Snowball: Pay off the Lowest Balance First

Making extra payments on the smallest loan and paying it off can give you a psychological boost early on. Then apply the payment amount of that loan to the loan with the next-lowest balance. With an even higher extra payment, you begin to pay that one off quickly as well.

“While the snowball strategy may not be the most financially efficient, the emotional return of paying off smaller loans can give you the motivation and commitment to continue proactively paying down your debt,” says Mike Rusinak of Fidelity’s Financial Solutions research team.

The avalanche approach is the most financially efficient because the extra payment goes to the loan with the highest interest rate. For instance, $2,000 paid against a 6% loan saves an average $5.00 in interest per month until the loan is paid off; whereas the same $2,000 paid against a 3% loan saves only $2.50 per month—assuming a 10-year loan term.

Once you’ve paid the highest rate loan off, direct the money that would have gone to that loan to the loan with the next-highest interest rate.

The impact of extra payments may be slightly different depending on your repayment plan—if you are on any of the income-driven repayment plans, then extra payments are not as straightforward; the math is similar, but there are a lot more moving parts.

Monday, July 10, 2017

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, July 7, the S&P 500 closed @ 2425, and that was...

+4.9% ABOVE its 12-Month moving average which stood @ 2312.

+5.1% ABOVE its 40-Week moving average which stood @ 2307.

+0.3% ABOVE its 10-Week moving average which stood @ 2418.

Therefore, the INTERMEDIATE-Term trend is NEUTRAL

and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Monday, July 3, 2017

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, June 30, the S&P 500 closed @ 2423, and that was...

+5.8% ABOVE its 12-Month moving average which stood @ 2291.

+5.3% ABOVE its 40-Week moving average which stood @ 2301.

+0.4% ABOVE its 10-Week moving average which stood @ 2414.

Therefore, the INTERMEDIATE-Term trend is NEUTRAL

and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Subscribe to:

Comments (Atom)