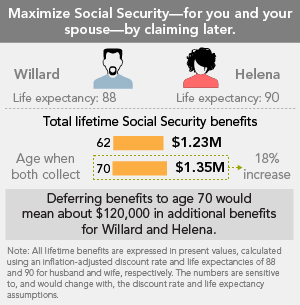

| Strategy No. 1: | Maximize Lifetime Benefits. |

A couple with similar incomes and ages may maximize lifetime benefits if both delay.

How it works: The basic principle is that the longer you defer your benefits, the larger they grow. Each year you delay Social Security from age 62 to 70 could increase your benefit by up to +8.0%.

Whom it may benefit: This strategy works best for couples with normal to high life expectancies with similar earnings, who are planning to work until age 70 or have sufficient savings to provide any needed income during the deferral period.

Example: Willard’s life expectancy is 88, and his income is $75,000. Helena’s life expectancy is 90, and her income is $70,000. They enjoy working. Suppose Willard and Helena both claim at age 62. As a couple, they would receive a lifetime benefit of $1,230,000. But if they live to be ages 88 and 90, respectively, deferring to age 70 would mean about $120,000 in additional benefits.

Learn More...

Read Viewpoints: “How the get the most from Social Security."- Watch Learning Center Video: Social Security: 5 key considerations to know before claiming your benefit.

- Visit the SSA website

to request your Social Security statement, calculate your FRA, or estimate your future retirement, disability, or survivor benefits. You can also get additional information in the FAQ section

to request your Social Security statement, calculate your FRA, or estimate your future retirement, disability, or survivor benefits. You can also get additional information in the FAQ section .

. - Enter your estimated Social Security benefit information into the Fidelity Planning & Guidance Center to see how Social Security fits with your overall retirement plan.

No comments:

Post a Comment