Friday, July 29, 2016

Wednesday, July 27, 2016

Monday, July 25, 2016

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, July 22, the S&P 500 closed @ 2175, and that was...

+5.4% ABOVE its 12-Month moving average which stood @ 2064.

+6.7% ABOVE its 40-Week moving average which stood @ 2038.

+3.5% ABOVE its 10-Week moving average which stood @ 2102.

Therefore, the INTERMEDIATE-Term trend is UP

and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Monday, July 18, 2016

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, July 15, the S&P 500 closed @ 2162, and that was...

+4.8% ABOVE its 12-Month moving average which stood @ 2062.

+6.2% ABOVE its 40-Week moving average which stood @ 2035.

+3.4% ABOVE its 10-Week moving average which stood @ 2090.

Therefore, the INTERMEDIATE-Term trend is NEUTRAL

and the LONG-Term trend is Moderately BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, July 15, 2016

Wednesday, July 13, 2016

Monday, July 11, 2016

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, July 8, the S&P 500 closed @ 2130, and that was...

+3.5% ABOVE its 12-Month moving average which stood @ 2057.

+4.9% ABOVE its 40-Week moving average which stood @ 2031.

+2.4% ABOVE its 10-Week moving average which stood @ 2079.

Therefore, the INTERMEDIATE-Term trend is NEUTRAL

and the LONG-Term trend is Moderately BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, July 8, 2016

Wednesday, July 6, 2016

Monday, July 4, 2016

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, July 1, the S&P 500 closed @ 2103, and that was...

+2.4% ABOVE its 12-Month moving average which stood @ 2053.

+3.8% ABOVE its 40-Week moving average which stood @ 2026.

+1.4% ABOVE its 10-Week moving average which stood @ 2073.

Therefore, the INTERMEDIATE-Term trend is NEUTRAL

and the LONG-Term trend is Moderately BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, July 1, 2016

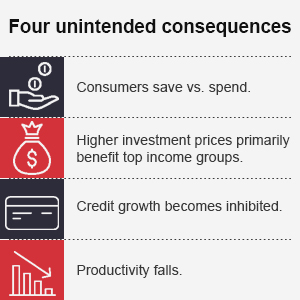

Negative Interest Rates

Labels:

consumer spending,

credit,

interest,

negative,

productivity,

rates,

save,

spending

Subscribe to:

Comments (Atom)