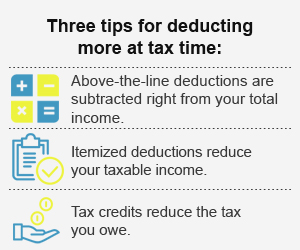

Tax Deductions come in two basic types:

“Above-the-Line” and “Below-the-Line.”

The “Line” is your Adjusted Gross Income, or AGI.

Above-the-Line deductions are subtracted from your total income, thus lowering your AGI.

Another advantage is that many “Above-the-Line” deductions are allowed under the Alternative Minimum Tax, or AMT.

A lower AGI can potentially increase the value of your Below-the-Line itemized deductions, which often come with limits.

For example, you can deduct your medical and dental expenses, but only the amount that exceeds 10% of your AGI (7.5% if you or your spouse is 65 or older) and only if you itemize deductions on your federal tax return.

So the lower your AGI, the quicker you hit 10% and can start deducting.

You can’t claim these expenses if you take the standard deduction which, for 2016, is $6,300 for taxpayers who are single or married filing separately, $12,600 for married filing jointly, and $9,300 for heads of household (single taxpayers with dependents).

No comments:

Post a Comment