Thursday, December 31, 2009

Top 3 Reasons Long-Term Care Insurance Is Not A Part of A Financial Plan

1. Confusion. People still don’t know what Long-Term Care Insurance (LTC) is. Doesn’t Medicare cover long term care needs? A recent study of boomers showed that 54% of them believed that Medicare would cover LTC. It won’t.

2. Denial. People still say, “It’s not going to happen to me.” Especially if they’re 36 or even 52. But show them the actual statistics and they’ll see that the odds are that 70% of people over age 65 end up needing long term care. And 40% of LTC costs still go to cover patients aged 18-64.

3. Fear. Nobody likes to talk about getting older, but it’s a conversation you need to have. What might happen if you or a loved one required long term care. Discussions about ill health are so unsettling and that’s caused many people to avoid taking the steps to make sure they are covered.

Like any life insurance, there are pros and cons to LTC, but when you think about the costs of LTC, you also have to think, “Who’s going to be changing my father’s clothes and giving my parents a bath when they’re incapable of doing so themselves?”

80% of care in the U.S. is provided by other family members; I would prefer to love my parents but have someone else oversee their daily care.

Most things in life are predictable. But should you need extended care, well … that’s the wild card. And I’m still dazzled by the degree to which most people are confused about LTC. It’s not the most important part of your financial plan, but it is an essential component.

If you’re an average person in your 40s, if you’re not taking the time to learn, take action and make the moves on LTC, you’re making a major mistake.

Wednesday, December 30, 2009

WSJ - Worst Decade in 200 Years for Inflation-Adjusted Returns

Many investors realize that stocks have been among the worst investments of the past decade. But they may not realize quite how bad the decade was, because most people forget about the effects of inflation.

Controlling for inflation takes extra work and makes stock gains look punier, so it is easy to see why stock analysts almost never do it. The media almost never do it either.

Since the end of 1999, the Standard & Poor's 500-stock index has lost an average of -3.3% a year on an inflation-adjusted basis, compared with a +1.8% average annual gain during the 1930s when deflation afflicted the economy, according to data compiled by Charles Jones, finance professor at North Carolina State University. His data use dividend estimates for 2009 and the consumer price index for the 12 months through November.

Even the 1970s, when a bear market was coupled with inflation, wasn't as bad as the most recent period. The S&P 500 lost -1.4% after inflation during that decade.

That is especially disappointing news for investors, considering that a key goal of investing in stocks is to increase money faster than inflation.

But other things do get measured in real dollars. When economists report whether the economy is growing, they account for inflation. When analysts judge long-term gains in commodities such as gold or oil, they often adjust for inflation, noting that gold hit a record this month in nominal terms but remains far from its 1980 record in real terms. Because analysts almost never do the same with stocks, it leaves investors with an exaggerated view of their portfolios' performance over time.

"Looking at returns on a nominal basis can be very misleading," says Richard Bernstein, a former chief investment strategist at Merrill Lynch who is launching a New York money-management firm called Richard Bernstein Capital Management. He checks inflation-adjusted performance to monitor investments' real value.

Labels:

commodities,

dow,

Gold,

inflation,

inflation-adjusted,

oil,

real dollars,

real return,

sp 500

Tuesday, December 29, 2009

WSJ - Not Even the 1930s Was As Bad As The Decade of the 2000s

The U.S. stock market is wrapping up what is likely to be its worst decade ever.

In nearly 200 years of recorded stock-market history, NO calendar decade has seen such a dismal performance as the 2000s.

Investors would have been better off investing in pretty much anything else, from bonds to gold or even just stuffing money under a mattress.

Since the end of 1999, stocks traded on the New York Stock Exchange have lost an average of -0.5% a year thanks to the twin bear markets this decade.

The 1950s represented the best decade for stock-market returns.So what went wrong for the U.S. stock market?

For starters, it turned out that the old rules of valuation matter.

"We came into this decade horribly overpriced," said Jeremy Grantham, co-founder of money managers GMO LLC.

In late 1999, the stocks in the S&P 500 were trading at about an all-time high of 44 times earnings, based on Yale professor Robert Shiller's measure, which tracks prices compared with 10-year earnings and adjusts for inflation. That compares with a long-run average P/E ratio of about 16.

Buying at those kinds of values, "you'd better believe you're going to get dismal returns for a considerable chunk of time," said Mr. Grantham, whose firm predicted 10 years ago that the S&P 500 likely would lose nearly -2% a year in the 10 years through 2009.

Despite the woeful returns this decade, stocks today aren't a steal. The S&P is trading at a price-to-earnings ratio of about 20 on Mr. Shiller's measure.

Mr. Grantham thinks U.S. large-cap stocks are about +30% overpriced, which means returns should be about -30% less than their long-term average for the next seven years.

That means returns of just +1.6% a year before adding in inflation.

In nearly 200 years of recorded stock-market history, NO calendar decade has seen such a dismal performance as the 2000s.

Investors would have been better off investing in pretty much anything else, from bonds to gold or even just stuffing money under a mattress.

Since the end of 1999, stocks traded on the New York Stock Exchange have lost an average of -0.5% a year thanks to the twin bear markets this decade.

The 1950s represented the best decade for stock-market returns.So what went wrong for the U.S. stock market?

For starters, it turned out that the old rules of valuation matter.

"We came into this decade horribly overpriced," said Jeremy Grantham, co-founder of money managers GMO LLC.

In late 1999, the stocks in the S&P 500 were trading at about an all-time high of 44 times earnings, based on Yale professor Robert Shiller's measure, which tracks prices compared with 10-year earnings and adjusts for inflation. That compares with a long-run average P/E ratio of about 16.

Buying at those kinds of values, "you'd better believe you're going to get dismal returns for a considerable chunk of time," said Mr. Grantham, whose firm predicted 10 years ago that the S&P 500 likely would lose nearly -2% a year in the 10 years through 2009.

Despite the woeful returns this decade, stocks today aren't a steal. The S&P is trading at a price-to-earnings ratio of about 20 on Mr. Shiller's measure.

Mr. Grantham thinks U.S. large-cap stocks are about +30% overpriced, which means returns should be about -30% less than their long-term average for the next seven years.

That means returns of just +1.6% a year before adding in inflation.

Labels:

best decade,

inflation,

overpriced,

P/E ratio,

valuation,

worst decade

Monday, December 28, 2009

WSJ - Government Now Rooted In The Economy - Bailout Mentality

In 2008 and 2009, Washington strove to save the economy.

In 2010, Americans will get a clearer picture of how Washington has changed the economy.

Only as the recession recedes will it become fully evident how permanently the state's role has expanded and whether, as a consequence, a new, hybrid strain of American capitalism is emerging.

One thing is clear: The government is a much bigger force in today's U.S. economy than it was before the financial crisis.

"The frontier between the state and market has shifted," says Daniel Yergin, whose 1998 book "Commanding Heights" chronicled the ascent of free-market forces starting in the 1980s. "The realm of the state has been enlarged."

Washington pumped $245 billion into nearly 700 banks and insurance companies, guaranteed almost $350 billion of bank debt, made short-term loans of more than $300 billion to blue-chip companies, propped up life insurers and money-market funds, bailed out two of the three U.S. auto makers, lent billions trying to jump-start commercial-real-estate, small-business and credit-card lending, and in two February stimulus bills enacted a year apart, committed $955 billion to rouse the economy.

Today the U.S. government, directly or indirectly, underwrites 9 of every 10 new residential mortgages, nearly twice the percentage before the crisis.

Just last week, the U.S. Treasury said it would cover an unlimited amount of losses at mortgage giants Fannie Mae and Freddie Mac through 2012.

John Taylor, a former Bush Treasury official who is now a Stanford University economist, says the government's role will be huge. "While we may be past the emergency, we're still in a mode that will create similar interventions for quite a while, even for minor emergencies," he says. "We have a bailout mentality in this country."

Even if the government withdraws, business will expect bailouts in the next crisis, and that will inspire another round of cavalier risk-taking.

"If we don't re-regulate the banking system properly, we'll either get very slow growth from overregulation, or another financial crisis in just 10 to 15 years," says Kenneth Rogoff, a Harvard University economist and co-author of a new book on financial crises since the Middle Ages.

In 2010, Americans will get a clearer picture of how Washington has changed the economy.

Only as the recession recedes will it become fully evident how permanently the state's role has expanded and whether, as a consequence, a new, hybrid strain of American capitalism is emerging.

One thing is clear: The government is a much bigger force in today's U.S. economy than it was before the financial crisis.

"The frontier between the state and market has shifted," says Daniel Yergin, whose 1998 book "Commanding Heights" chronicled the ascent of free-market forces starting in the 1980s. "The realm of the state has been enlarged."

Washington pumped $245 billion into nearly 700 banks and insurance companies, guaranteed almost $350 billion of bank debt, made short-term loans of more than $300 billion to blue-chip companies, propped up life insurers and money-market funds, bailed out two of the three U.S. auto makers, lent billions trying to jump-start commercial-real-estate, small-business and credit-card lending, and in two February stimulus bills enacted a year apart, committed $955 billion to rouse the economy.

Today the U.S. government, directly or indirectly, underwrites 9 of every 10 new residential mortgages, nearly twice the percentage before the crisis.

Just last week, the U.S. Treasury said it would cover an unlimited amount of losses at mortgage giants Fannie Mae and Freddie Mac through 2012.

John Taylor, a former Bush Treasury official who is now a Stanford University economist, says the government's role will be huge. "While we may be past the emergency, we're still in a mode that will create similar interventions for quite a while, even for minor emergencies," he says. "We have a bailout mentality in this country."

Even if the government withdraws, business will expect bailouts in the next crisis, and that will inspire another round of cavalier risk-taking.

"If we don't re-regulate the banking system properly, we'll either get very slow growth from overregulation, or another financial crisis in just 10 to 15 years," says Kenneth Rogoff, a Harvard University economist and co-author of a new book on financial crises since the Middle Ages.

Labels:

bailout,

capitalism,

crisis,

Economy,

financial

Saturday, December 26, 2009

Status of Our Vantage Point Investment Models

As of the close on Friday, December 25, the status of our Vantage Point Models is as follows:

Our Intermediate-Term Stock Model is NEGATIVE as of May 16, 2008.

Our SmallCap Momentum Model is NEGATIVE as of January 4, 2008.

Our Treasury Bond Model is NEGATIVE as of February 20, 2009.

Our High-Yield Bond Model is POSITIVE as of July 24, 2009.

In our relative strength work, we favor:

Our Intermediate-Term Stock Model is NEGATIVE as of May 16, 2008.

Our SmallCap Momentum Model is NEGATIVE as of January 4, 2008.

Our Treasury Bond Model is NEGATIVE as of February 20, 2009.

Our High-Yield Bond Model is POSITIVE as of July 24, 2009.

In our relative strength work, we favor:

- SmallCap funds over LargeCap funds (since 12/18/09)

- Value funds over Growth funds (since 11/13/09)

- U.S. funds over Foreign funds (since 11/20/09)

- SmallCap Value over LargeCap Growth (since 12/18/09)

Wednesday, December 23, 2009

Chart of The Day - Mid-Term Election Stats

Today's chart illustrates how the stock market has performed during the average mid-term election year. Since 1950, the first nine months of the average mid-term election year has tended to be flat/choppy. That choppiness was then followed by a year-end rally.

One theory to support this behavior is that the party in power will make difficult economic decisions in the early years of a presidential cycle and then do everything within its power to stimulate the economy during the latter years in order to increase the odds of re-election.

One theory to support this behavior is that the party in power will make difficult economic decisions in the early years of a presidential cycle and then do everything within its power to stimulate the economy during the latter years in order to increase the odds of re-election.

Labels:

chart of the day,

election,

mid-term,

stock market

Sunday, December 20, 2009

CARPE DIEM: Medicine is Complicated, So Are Computers: You Can Get Price for iMac, But Not Ingrown Toenail

CARPE DIEM: Medicine is Complicated, So Are Computers: You Can Get Price for iMac, But Not Ingrown Toenail

Health-care prices are a mishmash for lots of reasons, but one of the main ones is the way we pay for health care — you don’t pay the doctor, your insurance company does, an arrangement that gives at least two of the three parties involved a good incentive to obscure prices, so that the consumer has no idea how good or how rotten a deal he is getting while the insurers and hospitals attempt to game and swindle each other....

CARPE DIEM: Medicine is Complicated, So Are Computers: You Can Get Price for iMac, But Not Ingrown Toenail

Health-care prices are a mishmash for lots of reasons, but one of the main ones is the way we pay for health care — you don’t pay the doctor, your insurance company does, an arrangement that gives at least two of the three parties involved a good incentive to obscure prices, so that the consumer has no idea how good or how rotten a deal he is getting while the insurers and hospitals attempt to game and swindle each other....

CARPE DIEM: Medicine is Complicated, So Are Computers: You Can Get Price for iMac, But Not Ingrown Toenail

"January Effect" Stats from Ned Davis Research

From 1996 through 2008, Ned Davis Research (NDR) reports that a portfolio of “January Effect” stocks (a screen of the smallest stocks with the largest price declines in the S&P 500, the MidCap 400, and the SmallCap 600) has produced an average gain of +8.6% from mid-December through the end of January.

This easily exceeds the S&P 500’s average gain of +1.5% during the same time period.

The primary reasons behind the “January Effect” are tax-loss selling and “window dressing” – or perhaps more appropriately in this case, “window undressing.”

During the early part of December, institutional investors tend to harvest tax losses from their losing stocks in order to offset some of their gains (always a good idea).

But in addition, portfolio managers like to try and look smart at the end of the year. So many managers make a habit of dumping out their worst-performing stocks in order to ensure that these losers don’t show up on year-end statements.

Saturday, December 19, 2009

Status of Our Vantage Point Investment Models

As of the close on Friday, December 18, the status of our Vantage Point Models is as follows:

Our Intermediate-Term Stock Model is NEGATIVE as of May 16, 2008.

Our SmallCap Momentum Model is NEGATIVE as of January 4, 2008.

Our Treasury Bond Model is NEGATIVE as of February 20, 2009.

Our High-Yield Bond Model is POSITIVE as of July 24, 2009.

In our relative strength work, we favor:

Our Intermediate-Term Stock Model is NEGATIVE as of May 16, 2008.

Our SmallCap Momentum Model is NEGATIVE as of January 4, 2008.

Our Treasury Bond Model is NEGATIVE as of February 20, 2009.

Our High-Yield Bond Model is POSITIVE as of July 24, 2009.

In our relative strength work, we favor:

- SmallCap funds over LargeCap funds (since 12/18/09)

- Value funds over Growth funds (since 11/13/09)

- U.S. funds over Foreign funds (since 11/20/09)

- SmallCap Value over LargeCap Growth (since 12/18/09)

Friday, December 18, 2009

Chart of the Day - Tough Decade for NASDAQ

As the first decade of the new millennium rapidly comes to a close, today's chart takes a look back at the decade that was. Today's chart begins shortly after the stock market as well as the nation was partying like it's 1999 (i.e. dot-com boom).

The proverbial punch bowl was taken away early in 2000 and the NASDAQ suffered its 2 1/2 year dot-com bust. The market eventually bottomed and began a five-year rally thanks in part some infamous financial innovations (i.e. Ninja loans -- No Income, No Job, and no Assets).

Then as it became apparent that those financial innovations weren't quite as innovative as first hoped, the system went into near meltdown. Over the past nine months, the NASDAQ has been rallying (albeit at a pace that is slowing over time) and is currently testing resistance. All in all, a tough decade.

Wednesday, December 16, 2009

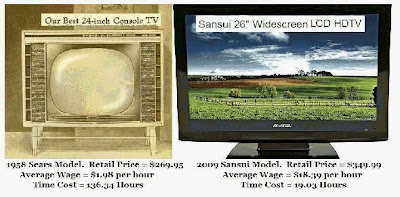

Got to Admit It’s Gotten Better - by Professor Mark J. Perry

To paraphrase Arthur Brooks, “If you’re not grateful to be an American holiday shopper this season, you’re not paying attention.”

An enlightening and timely study of how technological advancements and innovation create rising standards of living...

Got to Admit It’s Gotten Better

An enlightening and timely study of how technological advancements and innovation create rising standards of living...

Got to Admit It’s Gotten Better

Tuesday, December 15, 2009

WSJ: Why It May Pay To Convert to a Roth IRA

By KELLY GREENE

Investors and financial advisers are preparing to take advantage of a new tax law that makes it easier to gain access to Roth IRAs—even if it means breaking a sacrosanct rule about Roth conversions.

—Anne Tergesen contributed to this article.

Investors and financial advisers are preparing to take advantage of a new tax law that makes it easier to gain access to Roth IRAs—even if it means breaking a sacrosanct rule about Roth conversions.

Starting, January 1, the $100,000 income limit disappears for converting traditional individual retirement accounts and employer-sponsored retirement plans to Roth IRAs, one of the biggest changes on the IRA landscape in years. Roths, of course, have long been viewed as one of the best deals in retirement planning; after investors meet holding requirements, virtually all withdrawals are tax-free.

How many investors will make the leap is unclear. Converting to a Roth can be expensive; it requires paying income tax on all pretax contributions and earnings included in the amount converted. What's more, financial advisers have long argued that converting makes sense only if an investor can pay the tax from funds outside the IRA itself - an admonition that seemingly limits the strategy to the very wealthy.

That said, some financial advisers say growing numbers of their clients are leaning toward a Roth conversion, even if they have to tap their traditional IRAs to pay the taxes. The primary reasons: new, contrarian analyses of taxes and conversions—and a desire to gain more control over nest eggs in the years ahead. With a traditional IRA, investors must begin tapping their accounts after reaching age 70 1/2, which increases taxable income. With a Roth, there are no required distributions, giving retirees more flexibility in managing their investments and cash flow.

For many investors, "the required minimum distribution makes them sick," says John Neyland, president of JCN Financial Group in Baton Rouge, La. "They don't want the government to tell them when to take the money out."

Although only 5% of the country's $3.7 trillion IRA assets currently are held in Roths, about 13 million households holding more than $1.4 trillion in retirement assets will become newly eligible next month for conversions, says Ben Norquist, president of Convergent Retirement Plan Solutions LLC, a Brainerd, Minn., consulting firm. Vanguard Group predicts that 5% of its customers will do Roth conversions in 2010, up from a typical 1.5% rate. Charles Schwab & Co. found that 13% of 400 households with adjusted $100,000-plus incomes are considering converting at least part of their IRAs.

The income tax due on assets being moved to a Roth from a traditional IRA is a non-starter for many people, because few—including those with incomes of $100,000 or more—have the assets outside their tax-deferred accounts to pay the Internal Revenue Service. Others, who do have the money, are reluctant to part with it; such funds, often, are set aside for emergencies.

But some financial planners, after running projections involving retirement savings, withdrawals and taxes in coming decades, have concluded that it's worthwhile for many in this group to convert at least some of their IRA assets to a Roth—and pay the tax with funds inside the IRA.

"I have a case where my client is 60, and I was surprised to find that she comes out ahead whether she pays the tax with cash \[outside the IRA\] or the assets inside the IRA," says Deborah Linscott, a financial adviser in Dublin, Ohio.

Here's why: Even though individuals who convert and who decide to pay the tax bill with funds inside their IRA are lowering their overall IRA balance, their new Roth account eliminates the requirement to make taxable withdrawals after age 70 1/2. For some people, that means they can stay below the threshold at which much of their Social Security checks would be taxed. Others can avoid higher Medicare premiums (which are tied to income levels). And a few could wind up leaving larger legacies down the road, since inherited Roth IRAs aren't subject to income tax, either.

Bob Phillips, a 64-year-old retired engineer in suburban Cleveland, plans to covert his traditional IRA valued at $552,000 to a Roth. He has only about $8,000 in cash, so he plans to pay the tax from his IRA assets, which will reduce his retirement savings. But when Mr. Phillips turns 70 1/2, he won't have to make any taxable withdrawals, meaning the $35,000 in Social Security benefits that he and his wife receive annually shouldn't become taxable.

If the Phillipses can avoid losing about 20% of their Social Security to taxes, their Roth withdrawals—should they need them—will be smaller, as well. That, in turn, gives the Roth a better chance to grow with time, says Mark Tepper, the couple's investment adviser.

Mr. Tepper used 10,000 "Monte Carlo" simulations (designed to estimate the odds of reaching financial goals) and found that, without doing a Roth conversion, they have only a 50-50 chance of making their funds last across their life expectancies. With a Roth conversion, even using assets from the account itself to pay the tax, they have an 88% chance of not outliving their savings.

Some additional points to consider:

— Investors weighing Roth conversions may want to run their plans by a local accountant: At least one state, Wisconsin, didn't drop the $100,000 income limit, meaning unwitting residents over that limit face a penalty for Roth conversions.

— IRA owners with Medicare Part B who convert to a Roth may subject themselves for a year or two to higher premiums (which, again, are tied to income).

— Investors under age 59 1/2 who convert to a Roth would pay an early-withdrawal penalty on IRA assets used to pay tax.

— Using IRA assets to pay the tax man reduces the amount you could later "recharacterize": If the converted Roth assets fall in value, you are allowed to recharacterize the account as a traditional IRA and no longer owe the tax. "But if you take $100,000 out of your IRA and you only roll $80,000 into a Roth, you only have $80,000 to recharacterize, not the whole thing," says Ed Slott, an IRA consultant in Rockville Centre, N.Y.

—Anne Tergesen contributed to this article.

Write to Kelly Greene at kelly.greene@wsj.com

Labels:

conversion,

Ed Slott,

IRA,

retirement,

Roth

Monday, December 14, 2009

Why The Stimulus Hasn't Worked. And Won't Work. Ever.

"We've got to keep spending, to keep from going bankrupt." — Vice President, Joe Biden

Brilliant observation, Joe. No wonder the economy is on life support.

Think of the U.S. economy like a household. If you were in trouble financially, how would you be FORCED to behave?

The U.S. government is destroying value by increasing spending astronomically. That's why the U.S. dollar is in a free fall. A conceptually bankrupt plan cannot work, and President Obama cannot reach his stated goal of halving the deficit by 2013 on the current track. Our economy will not soon spring back to health. The more the government spends and the more it interferes in the financial system, the riskier every entrepreneurial or investing endeavor becomes.

After 10 stimulus packages, Japan had little to show for its efforts. It was what economists call a "Lost Decade." Make that TWO Lost Decades!

During the '90s, Japan's economy grew a paltry +0.5% a year — way down from a +3%-plus average in the preceding 20 years. And its net wealth plunged by -$16 trillion, more than three times the size of the Japanese economy.

Japan does have one lingering legacy from this: a Total Debt of roughly 200% of GDP, the developed world's highest. This has and will continue to hinder Japan's economy and, along with aging demographics, slow economic and productivity growth for the rest of this century.

Two decades of borrowed and spent stimulus have failed miserably in Japan, which is now drowning in debt.

Are we wise enough to learn from Japan's mistakes or foolish enough to follow Japan down the road to fiscal and financial ruin?

Brilliant observation, Joe. No wonder the economy is on life support.

Think of the U.S. economy like a household. If you were in trouble financially, how would you be FORCED to behave?

- You'd cut spending dramatically.

- You'd stop all borrowing immediately and pay down existing debt as fast as possible.

- You'd refuse to lend anyone money.

- You'd stop all charitable giving until you got back on your feet.

- You'd try to be as productive as possible, perhaps taking on a second job or starting a new business to bring in more money.

The U.S. government doing the EXACT opposite, isn't it? Borrowing isn't being curtailed. It's increasing exponentially. Spending isn't being cut. The bigger the hole gets, the more the politicians keep digging.

If borrowing and spending what you don't have won't rescue your household from financial ruin, how can it possibly remedy the economy's predicament?

It can't, because unrestrained borrowing and spending is the antithesis of financial security.

It can't, because unrestrained borrowing and spending is the antithesis of financial security.

The economy, we're told depends on credit. That's exactly backwards, and is no more correct than if you'd said your own prosperity depends on credit. It doesn't.

Credit depends on the economy and the existence of capital, which is only accumulated through savings, not spending. The only way you can truly stimulate the economy in a lasting way is to cut the burden of government immediately, dramatically and permanently.

The U.S. government is destroying value by increasing spending astronomically. That's why the U.S. dollar is in a free fall. A conceptually bankrupt plan cannot work, and President Obama cannot reach his stated goal of halving the deficit by 2013 on the current track. Our economy will not soon spring back to health. The more the government spends and the more it interferes in the financial system, the riskier every entrepreneurial or investing endeavor becomes.

We only have to look to Japan for an example of the folly of blindly embracing the desperate delusion that it's possible to borrow your way to prosperity with stimulus by running deficits of over 200% of GDP.

During the '90s, Japan's economy grew a paltry +0.5% a year — way down from a +3%-plus average in the preceding 20 years. And its net wealth plunged by -$16 trillion, more than three times the size of the Japanese economy.

Japan does have one lingering legacy from this: a Total Debt of roughly 200% of GDP, the developed world's highest. This has and will continue to hinder Japan's economy and, along with aging demographics, slow economic and productivity growth for the rest of this century.

Two decades of borrowed and spent stimulus have failed miserably in Japan, which is now drowning in debt.

Are we wise enough to learn from Japan's mistakes or foolish enough to follow Japan down the road to fiscal and financial ruin?

Sunday, December 13, 2009

Status of Our Vantage Point Investment Models

As of the close on Friday, December 11, the status of our Vantage Point Models is as follows:

Our Intermediate-Term Stock Model is NEGATIVE as of May 16, 2008.

Our SmallCap Momentum Model is NEGATIVE as of January 4, 2008.

Our Treasury Bond Model is NEGATIVE as of February 20, 2009.

Our High-Yield Bond Model is POSITIVE as of July 24, 2009.

In our relative strength work, we favor:

Our Intermediate-Term Stock Model is NEGATIVE as of May 16, 2008.

Our SmallCap Momentum Model is NEGATIVE as of January 4, 2008.

Our Treasury Bond Model is NEGATIVE as of February 20, 2009.

Our High-Yield Bond Model is POSITIVE as of July 24, 2009.

In our relative strength work, we favor:

- LargeCap funds over SmallCap funds (since 10/23/09)

- Value funds over Growth funds (since 11/13/09)

- U.S. funds over Foreign funds (since 11/20/09)

- LargeCap Growth over SmallCap Value (since 10/30/09)

Friday, December 11, 2009

Q&A: Pimco's Mohamed El-Erian - Courtesy of Fortune Magazine

Pimco's CEO says individual investors must change their investing style, such as being less U.S.-centric.

By Geoff Colvin, senior editor at large

Pimco, the world's largest bond investor, has benefited from investors' flight to quality over the past two years and now manages about $1 trillion in assets.

Pimco, the world's largest bond investor, has benefited from investors' flight to quality over the past two years and now manages about $1 trillion in assets. Mohamed El-Erian, 51, is still thinking large and deep thoughts; his book, "When Markets Collide: Investment Strategies for the Age of Global Economic Change," won the Financial Times Goldman Sachs business book of the year award last year.

Mr. El- Erian sat down recently with Fortune's Geoff Colvin to talk about threats to individual investors, the best framework for an investment portfolio, how the 2008 financial meltdown was like a double-drive-through McDonald's, and much else.

Here's a sampling of some of the questions....

We've had one quarter of solid economic growth. Is the recession over?

We've had one quarter of solid economic growth. Is the recession over? Why are a lot of very positive things unlikely to occur for the consumer?

If American consumers start saving more, isn't that a good thing?

From the perspective of an individual investor, is the multipolar world a good thing or a bad thing?

What are the most important things that individual investors need to do differently?

What's the best protection for an individual investor against inflation?

In your book you present an asset allocation for a typical U.S. investor. Only 15% is in U.S. equities, which is much less than most U.S. investors hold. And only 14% is in bonds, U.S. and non-U.S., which seems like not very much. What's the logic?

You've said that this asset allocation -- which includes many other elements [see table] -- could be expected to return +5% to +7% a year in real terms over the long run. Many investors believe that U.S. equities will return much more over time. Is that just not correct?

A lot of new financial regulation is in the works. Is it going to be, as it so often is, regulation that will prevent the crisis that just happened and not regulation that will prevent the next crisis?

After the September 2008 crisis, you mentioned in Fortune that you'd asked your wife to withdraw cash from the bank. What was your life like?

What's your bottom line advice to individual investors in today's environment?

Full Interview - Click Here: Investing Advice from Mohamed El-Erian: Q&A with Fortune - Dec. 10, 2009

Labels:

asset allocation,

Bonds,

commodities,

consumer,

economic growth,

Economy,

El-Erian,

emerging,

equities,

Fortune,

individual investor,

inflation,

pimco,

recession

Thursday, December 10, 2009

The Top 10 Worst Recessions Of The Last 80 Years

Below are listed the Top 10 Worst Recessions of the last 80 years ranked by official duration...

1929-1933, 43 months in duration (Great Depression).

2007-2008, 24 months in duration?*

1981-1982, 16 months in duration.

1973-1975, 16 months in duration.

1937-1938, 13 months in duration.

1926-1927, 13 months in duration.

1970, 11 months in duration.

1948-1949, 11 months in duration.

1960-1961, 10 months in duration.

1953-1954, 10 months in duration.

* - Current Recession officially began December 2007 and based on current market data has not yet officially concluded.

The following chart from Fidelity gives a very clear breakdown of all 15 recessions, their duration, and severity as far as stock market damage during and after the recession ended.

1929-1933, 43 months in duration (Great Depression).

2007-2008, 24 months in duration?*

1981-1982, 16 months in duration.

1973-1975, 16 months in duration.

1937-1938, 13 months in duration.

1926-1927, 13 months in duration.

1970, 11 months in duration.

1948-1949, 11 months in duration.

1960-1961, 10 months in duration.

1953-1954, 10 months in duration.

* - Current Recession officially began December 2007 and based on current market data has not yet officially concluded.

The following chart from Fidelity gives a very clear breakdown of all 15 recessions, their duration, and severity as far as stock market damage during and after the recession ended.

If the current recession officially surpasses the 2nd quarter of 2009, the United States will be able to declare the 2007 - 2009 Great Recession as the worst since the Great Depression.

Wednesday, December 9, 2009

Goldman Sachs: "13 Million Foreclosures in the Next 5 Years"

Foreclosure Stat Snapshots

1) More than 1.5 million homes have been lost to foreclosure already, according to the Center for Responsible Lending.

2) Goldman Sachs is projecting 13 million foreclosures of ALL types during the next 5 years.

3) One in 10 homeowners are late with mortgage payments, according to the Mortgage Bankers Association.

4) Owners owe more than the home is worth in nearly 1 in 5 homes, according to First American Core Logic.

5) Banks are braced for record debt defaults in the 2010 New Year.

6) 7.5 million foreclosure sales will have taken place between 2006 and 2011.

7) The majority of those 7.5 million foreclosure sales, however, have not been completed yet, with 4.8 million foreclosure sales expected between 2009 and 2011.

8) In Florida, about 2 million of 4.6 million home mortgages were underwater, a rate of 45%.

10) If 1 in 5 of those 21 million households default, the losses to banks and investors could exceed -$400 billion.

As a proportion of the economy, that's roughly equivalent to the losses suffered in the savings-and-loan debacle of the late 1980s and early 1990s.

1) More than 1.5 million homes have been lost to foreclosure already, according to the Center for Responsible Lending.

2) Goldman Sachs is projecting 13 million foreclosures of ALL types during the next 5 years.

3) One in 10 homeowners are late with mortgage payments, according to the Mortgage Bankers Association.

4) Owners owe more than the home is worth in nearly 1 in 5 homes, according to First American Core Logic.

5) Banks are braced for record debt defaults in the 2010 New Year.

6) 7.5 million foreclosure sales will have taken place between 2006 and 2011.

7) The majority of those 7.5 million foreclosure sales, however, have not been completed yet, with 4.8 million foreclosure sales expected between 2009 and 2011.

8) In Florida, about 2 million of 4.6 million home mortgages were underwater, a rate of 45%.

9) Analysts at Deutsche Bank Securities expect 21 million U.S. households to end up owing more on their mortgages than their homes are worth by the end of 2010.

10) If 1 in 5 of those 21 million households default, the losses to banks and investors could exceed -$400 billion.

As a proportion of the economy, that's roughly equivalent to the losses suffered in the savings-and-loan debacle of the late 1980s and early 1990s.

Moody's: "Potential Downgrade of U.S. Debt Not Inconceivable"

Moody’s suggested that even the United States and the U.K. are not safe from seeing their coveted triple-A credit ratings tarnished down the road.

In a report titled, “AAA Sovereign Monitor,” which Moody’s will now update quarterly, the rating agency said that the U.S. and U.K must show that they can reduce their ballooning deficits in order to avoid threats to their triple-A credit ratings.

In this quarter’s report, both the United States and the United Kingdom were singled out from the rest of the 17 nations that currently enjoy a triple-A rating on their sovereign debt. The report used the term “resilient” when describing the U.S. and U.K. while the word “resistant” was applied to rest of the triple-A club.

The Wall Street Journal reports that under the most pessimistic scenario Moody's devised, the U.S. could possibly lose its coveted triple-A rating in 2013… IF the following scenario were to unfold:

"Economic growth proves anemic, interest rates rise, and the government fails to reduce the deficit and/or recover most of its assistance to the financial sector."

The chief international economist at Moody’s points out that unlike several years ago, “now the question of a potential downgrade of the U.S. is not inconceivable.”

In the U.S., a "credible fiscal consolidation strategy" is said to be required in order to prevent the debt load and associated interest costs from tipping into the ratings agency's most pessimistic scenario, the report said.

Moody’s says that the most likely path for both the U.S. and the U.K. involves modest economic growth and a program of deficit reduction. The report also makes it clear that neither country is at risk of losing their credit rating in the near term.

The report notes that "the trajectory of the debt metrics, while unfavorable in the near term, does not currently threaten the ratings" of countries like the U.S. and the U.K."

In a report titled, “AAA Sovereign Monitor,” which Moody’s will now update quarterly, the rating agency said that the U.S. and U.K must show that they can reduce their ballooning deficits in order to avoid threats to their triple-A credit ratings.

In this quarter’s report, both the United States and the United Kingdom were singled out from the rest of the 17 nations that currently enjoy a triple-A rating on their sovereign debt. The report used the term “resilient” when describing the U.S. and U.K. while the word “resistant” was applied to rest of the triple-A club.

The Wall Street Journal reports that under the most pessimistic scenario Moody's devised, the U.S. could possibly lose its coveted triple-A rating in 2013… IF the following scenario were to unfold:

"Economic growth proves anemic, interest rates rise, and the government fails to reduce the deficit and/or recover most of its assistance to the financial sector."

The chief international economist at Moody’s points out that unlike several years ago, “now the question of a potential downgrade of the U.S. is not inconceivable.”

In the U.S., a "credible fiscal consolidation strategy" is said to be required in order to prevent the debt load and associated interest costs from tipping into the ratings agency's most pessimistic scenario, the report said.

Moody’s says that the most likely path for both the U.S. and the U.K. involves modest economic growth and a program of deficit reduction. The report also makes it clear that neither country is at risk of losing their credit rating in the near term.

The report notes that "the trajectory of the debt metrics, while unfavorable in the near term, does not currently threaten the ratings" of countries like the U.S. and the U.K."

Tuesday, December 8, 2009

Seniors Hold The Most IRA Assets

- 72.7% — Percentage of IRA assets held by someone 55 or older, despite the fact that only 45.7% of the population of IRA-owners are 55 or older .

- 25.4% — Percentage of retirement wealth represented by IRAs in 2008.

- 19.6% — Percentage of IRA owners between 60 and 64 who are taking withdrawals from their IRAs; the percentage of the aggregate IRA balance withdrawn for this age group is 3.8%.

- 28.6% — Percentage of 65- to 69-year-old IRA owners who are taking withdrawals; the aggregate IRA balance withdrawn is 3.9%.

- 93.0% — Percentage of IRA owners 70 and older who are taking withdrawals; the aggregate IRA balance withdrawn is 6.5%.

Four Common Retirement Mistakes

by Danielle Andrus @ Senior Market Advisor

Retirement planning encompasses more than just securing an income for your clients after they stop working; health care and estate planning are major parts of the retirement equation.

The Wall Street Journal recently outlined four common mistakes financial advisors are seeing their clients make that could spell disaster for their already precarious retirements. As the paper points out, retirement planning encompasses more than just securing an income for your clients after they stop working; health care and estate planning are major parts of the retirement equation.

Retirement planning encompasses more than just securing an income for your clients after they stop working; health care and estate planning are major parts of the retirement equation.

The Wall Street Journal recently outlined four common mistakes financial advisors are seeing their clients make that could spell disaster for their already precarious retirements. As the paper points out, retirement planning encompasses more than just securing an income for your clients after they stop working; health care and estate planning are major parts of the retirement equation.

- Putting too much faith in bonds. Massive losses on stocks have made many retirees hesitant to stay invested in them; instead they opt for bonds, but the Journal offers a warning. Lawrence Glazer, of Boston-based Mayflower Advisors, told the paper, “It's a fallacy to think you can't lose money in bonds.” Credit risk, splendidly exemplified by Lehman Brothers last year, is a major concern. Likewise, low interest rates can lead retirees to reach for longer maturities and greater risk.

- Overspending. Your clients need a realistic spending budget, as well as a sustainable withdrawal rate, the paper writes. They also need to factor in rising health care costs and inflation. Another variable that is often overlooked by retirees is unexpected big expenses or big investment losses. As the past year has demonstrated, a back-up plan for sudden market losses is an important part of your clients’ retirement plans.

- Not maintaining their legacy. A will does not necessarily guarantee your clients’ assets will go to the people they want them to, although many people assume it’s sufficient, New York attorney Philip Bouklas told the paper. Your clients should have, and regularly update, a will, health care proxy and beneficiaries on their retirement accounts.

- Not broaching the subject. No one likes to talk about their own mortality, but it’s important for your clients to have a plan for what will happen to their assets after their death, or if they’re incapacitated due to an illness or disability.

Labels:

Bonds,

estate,

mistakes,

planning,

retirement

Sunday, December 6, 2009

Q&A: Paying Taxes After a Roth IRA Conversion - Ask Encore @ WSJ.com

Ask Encore @ WSJ.com

Focus on Retirement - By KELLY GREENE

Q: In 2010, when the income limits are lifted for converting a traditional IRA to a Roth IRA, my wife and I plan to convert about $50,000 in traditional IRAs. We plan to pay the taxes with funds from outside the IRA and also to pay them all in the 2010 tax year.

Our question is this: At what time during the 2010 tax year are the taxes due? For example, if we convert in January 2010, do we need to pay estimated taxes for first quarter of 2010 by April 15, 2010? Or can we wait to pay the taxes until we file our 2010 taxes in March or April of 2011—without incurring a penalty for being "under-withheld"?

If we would need to pay quarterly estimated taxes, it would probably cause us to defer the conversion until the fourth quarter of 2010, and thus not owe the taxes until 2011.

—Paul Sklar Pittsburgh, PA

A: You're ahead of the game, because many people have no idea that converting assets to a Roth IRA could affect the timing of their tax payments.

To review: Effective Jan. 1, 2010, the federal government is permanently dropping the income limit for transferring savings to a Roth IRA from a traditional individual retirement account or employer-sponsored retirement plan. Although such conversions will be subject to income tax, future withdrawals (that meet holding requirements) would be tax-free.

One important thing to think about in terms of timing: Delaying a Roth conversion until the fourth quarter of next year might help you delay paying the tax involved; but if your IRA has fallen in value in the past few years, you may want to convert the account as soon as possible next year, before its value recovers further, to keep the tax bill as low as you can.

"What have you accomplished if the value of the IRA goes up in that time and you pay tax on it?" says Barry Picker, a certified financial planner and certified public accountant in New York. "It could have been in a Roth growing tax-free."

Adds Lester Law, national wealth strategist for U.S. Trust, Bank of America Private Wealth Management: "This is not a tax payment decision; it's an investment and estate-planning decision. Don't let the tax tail wag the dog."

Generally, you have three options for paying income tax throughout the year, and thus avoiding a penalty and interest for underpayment of your income tax.

One Other Note: Conversion income might drive up your state income taxes as well. To get a definitive answer for a specific state or local government, you should check with a local accountant.

Write to Ask Encore at encore@wsj.com

Focus on Retirement - By KELLY GREENE

Q: In 2010, when the income limits are lifted for converting a traditional IRA to a Roth IRA, my wife and I plan to convert about $50,000 in traditional IRAs. We plan to pay the taxes with funds from outside the IRA and also to pay them all in the 2010 tax year.

Our question is this: At what time during the 2010 tax year are the taxes due? For example, if we convert in January 2010, do we need to pay estimated taxes for first quarter of 2010 by April 15, 2010? Or can we wait to pay the taxes until we file our 2010 taxes in March or April of 2011—without incurring a penalty for being "under-withheld"?

If we would need to pay quarterly estimated taxes, it would probably cause us to defer the conversion until the fourth quarter of 2010, and thus not owe the taxes until 2011.

—Paul Sklar Pittsburgh, PA

A: You're ahead of the game, because many people have no idea that converting assets to a Roth IRA could affect the timing of their tax payments.

To review: Effective Jan. 1, 2010, the federal government is permanently dropping the income limit for transferring savings to a Roth IRA from a traditional individual retirement account or employer-sponsored retirement plan. Although such conversions will be subject to income tax, future withdrawals (that meet holding requirements) would be tax-free.

One important thing to think about in terms of timing: Delaying a Roth conversion until the fourth quarter of next year might help you delay paying the tax involved; but if your IRA has fallen in value in the past few years, you may want to convert the account as soon as possible next year, before its value recovers further, to keep the tax bill as low as you can.

"What have you accomplished if the value of the IRA goes up in that time and you pay tax on it?" says Barry Picker, a certified financial planner and certified public accountant in New York. "It could have been in a Roth growing tax-free."

Adds Lester Law, national wealth strategist for U.S. Trust, Bank of America Private Wealth Management: "This is not a tax payment decision; it's an investment and estate-planning decision. Don't let the tax tail wag the dog."

Generally, you have three options for paying income tax throughout the year, and thus avoiding a penalty and interest for underpayment of your income tax.

- The first is to pay 100% of last year's tax, or 110% of last year's tax if your adjusted gross income is over $150,000 for individuals or for married couples who file joint tax returns. This method is the one most commonly used and it will probably work for most people who plan to pay any income tax for a 2010 Roth conversion as part of their 2010 tax return, Mr. Law says.

- The second option is to pay 90% of the current year's tax, which is something that people who convert a large amount to a Roth in 2010 may want to consider doing in 2011 as a way to lower the tax amounts that they pay quarterly or have withheld from their paychecks, he says.

- The third option is to estimate your income each quarter and pay tax on it for that quarter, Mr. Law says.

One Other Note: Conversion income might drive up your state income taxes as well. To get a definitive answer for a specific state or local government, you should check with a local accountant.

Write to Ask Encore at encore@wsj.com

Labels:

2010,

2011,

conversion,

IRA,

Roth,

state income taxes

Friday, December 4, 2009

Chart of The Day - Job Losses Are Over 3 Times The Average Trough

Today, the Labor Department reported that nonfarm payrolls (jobs) decreased by 11,000 in November -- the smallest decline since the recession began at the close of 2007.

Today's chart puts that decline into perspective by comparing job losses during the current economic recession (solid red line) to that of the last recession (dashed gold line) and the average recession from 1950-2006 (dashed blue line).

As today's chart illustrates, the current job market has suffered losses that are more than triple as much as what occurs at the lows of the average recession/job loss cycle.

Labels:

chart of the day,

job losses,

job market,

jobs,

nonfarm payrolls,

recession

Wednesday, December 2, 2009

Whoa! - The Money Supply Explodes +120%!

The money supply has gone parabolic!

In the past year the Federal Reserve has increased the money supply by a whopping +120%. That's never happened before. Recall that in the 1970s the Fed increased the money supply +13% and inflation soared into the double digits.

Gee, I wonder what inflation is going to be like after the money supply more than doubles?

Now you know one of the primary reasons why:

- Savvy investors and central banks around the world are exchanging this flood of depreciating dollars for gold, commodities and other hard assets.

- India just bought 200 tons of gold and is thinking about buying 200 more.

- Gold bullion posted another new high today, closing above $1,200 for the first time!

Chart courtesy of www.StockCharts.com

Labels:

commodities,

Fed,

Federal Reserve,

Gold,

inflation,

money supply

Tuesday, December 1, 2009

The Next Shoe To Drop?: Commercial Real Estate Defaults Double

Real Estate Econometrics LLC says commercial mortgage default rate on loans held by U.S. banks more than doubled to 3.4% in the third quarter as vacancies rose and rents declined.

Defaults climbed from 1.37% a year earlier and from 2.88% in the second quarter, the New York-based property research firm said today in a report.

Default rates in the first three quarters of 2009 have been the highest since 1993, the firm said.

“Mortgages originated in 2006 and 2007 are experiencing the most significant shortfalls in current cash flow relative to current debt-service obligations,” Sam Chandan, chief economist of the firm, said in the report.

Federal Reserve Chairman Ben S. Bernanke said in a November 16 speech that “the fallout” for banks from commercial real estate could slow the nation’s economic recovery.

Defaults on bank-owned commercial property mortgages posted the biggest quarterly jump from the previous quarter in six years of FDIC data analyzed by Real Estate Econometrics.

Labels:

commercial,

default rate,

Federal Reserve,

mortgage,

real estate

Subscribe to:

Posts (Atom)

![[ROTHTAX]](http://s.wsj.net/public/resources/images/MI-BA295_ROTHTA_NS_20091211182100.gif)