Monday, June 29, 2015

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, June 26, the S&P 500 closed @ 2101, and that was...

+3.4% ABOVE its 12-Month moving average which stood @ 2032.

+2.1% ABOVE its 40-Week moving average which stood @ 2059.

-0.4% BELOW its 10-Week moving average which stood @ 2110.

Therefore, the INTERMEDIATE-Term trend is NEUTRAL

and the LONG-Term trend is UP.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, June 26, 2015

Wednesday, June 24, 2015

Monday, June 22, 2015

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, June 19, the S&P 500 closed @ 2110, and that was...

+3.7% ABOVE its 12-Month moving average which stood @ 2034.

+2.6% ABOVE its 40-Week moving average which stood @ 2056.

+0.1% ABOVE its 10-Week moving average which stood @ 2108.

Therefore, the INTERMEDIATE-Term trend is NEUTRAL

and the LONG-Term trend is UP.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, June 19, 2015

Annuities: Understanding the Difference Between Fixed And Variable Annuities

Do you know how much the fees and expenses associated with your retirement investments are?

Annuities offer tax sheltered growth which can result in significant long-term returns for you if you contribute to the annuity for a long period and wait to withdraw funds until retirement. You get peace of mind from a guaranteed income stream, and the tax benefits of deferred annuities can amount to substantial savings.

There are Two Categories of Annuities – Fixed and Variable

Annuities offer tax sheltered growth which can result in significant long-term returns for you if you contribute to the annuity for a long period and wait to withdraw funds until retirement. You get peace of mind from a guaranteed income stream, and the tax benefits of deferred annuities can amount to substantial savings.

There are Two Categories of Annuities – Fixed and Variable

A Fixed Rate Annuity is sold by an Insurance

Company and offers you a very low-risk retirement account. The owner is

guaranteed at least a minimum rate of investment return. The insurer declares a

specific credited rate of return based on the investment performance of its general

account assets. You can receive a fixed amount of money every month for the

rest of your life. However, the price for removing risk is missing out on

growth opportunity. Should the financial markets enjoy bull market conditions

during your retirement, you forgo additional gains on your annuity funds.

A Variable Annuity is sold by a stockbroker and

is classified as a Security Investment by the SEC. A variable annuity is

subject to stock market risk. With a variable annuity, contract owners are able

to choose from a wide range of investment options called subaccounts, each of

which generally invests in shares of a single underlying mutual fund. As with

mutual funds, the investment return of variable annuities fluctuates. The most

common objection to variable annuities is how notoriously expensive they can

be.

A Variable Annuity with $100,000 in account value would pay $3,750 per year in fees before any interest is credited.

Fixed Annuities Offer Less Investment Risk. Generally,

fixed annuities involve less investment risk than variable annuities because

they offer a guaranteed minimum rate of interest. The minimum rate is not

affected by fluctuations in market interest rates or the company’s yearly

profits. Most people like the security of knowing that their annuity payments

will never vary or that they will receive at least a minimum amount of credited

interest.

Here are a few Guidelines to Consider When Making a

Change to Your Retirement Portfolio:

Buy From Someone Reputable. Whether you are

working through an adviser or directly through a distributor, get the facts on

the firm’s financial strength and business practices. What is the company’s

rating with third-party ratings agencies? Is it known for fair claims-paying

practices? How reliable is its customer service? Dealing with a company that is

fair and financially sound may help save you from financial headaches in the

long run.

Educate yourself. Knowledge is Power. Make sure

to ask your financial adviser about any potential costs that might not be

apparent. The point here is to completely understand what you are paying for

and how to utilize the benefits when you need them.

Be sure to consider annuities as part of your overall

investment strategy, as they can add value and security to your retirement.

Watch the video below for more information on the fees

and expenses associated with Variable Annuities...

Wednesday, June 17, 2015

Case Study: Managing Taxation on Retirement Income Withdrawals

Case Study: Managing Taxation on Retirement Income Withdrawals

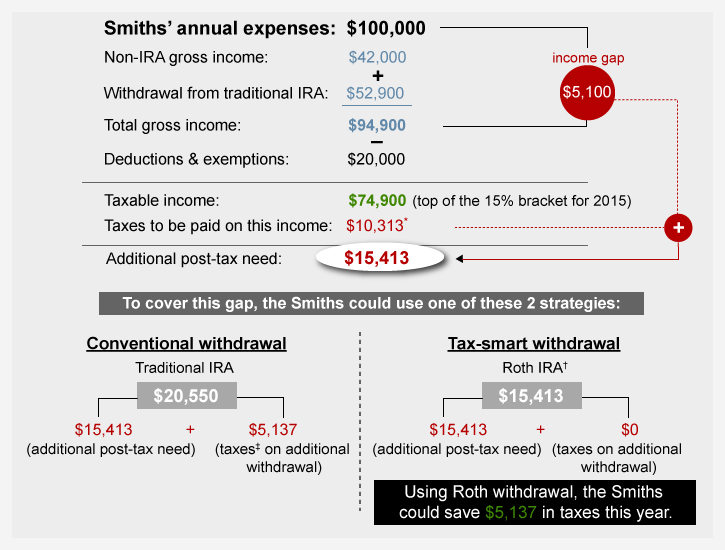

As a way to help minimize the income taxes one pays, consider the following hypothetical scenario.

It illustrates the way a retired married couple whose annual expenses total $100,000 might seek to manage their taxes.

Our hypothetical couple expects $42,000 in gross income (all taxable) before tapping their retirement accounts, so their gross income gap—(before considering taxes)—is $58,000. They anticipate $20,000 in deductions and exemptions, so their expected taxable income before withdrawals is $22,000. If they withdraw $52,900 from their traditional IRAs, it would bring their taxable income to $74,900—the top of the 15% bracket for 2015.

They could then withdraw the remaining $5,100 that they need to cover their income gap from a Roth IRA, which does not generate taxable income (assuming the withdrawal is qualified). The chart below shows their cash flow and taxable income:

Example: How to Manage Taxes on Withdrawals for Retirement Accounts

This hypothetical example is for illustrative purposes only. This hypothetical scenario assumed the couple does not receive Social Security benefits. Social Security income would further complicate the tax scenario described above and should be considered when creating a withdrawal strategy.

Other Options for Our Hypothetical Couple

The hypothetical couple in this scenario leaves the bulk of Roth IRA assets alone, leaving them in place to potentially generate tax-free growth. In certain situations, however, it may be advantageous to tap Roth assets instead of tax-deferred or taxable accounts. These include situations when:

- Any distributions at all from a tax-deferred account would cause your taxable income to exceed your target marginal tax rate

- Withdrawing from a taxable account would require selling assets held less than a year, resulting in short-term capital gains, which are taxed at ordinary income tax rates

- You are also trying to minimize taxes on Social Security benefits, and withdrawals from a tax-deferred account would have an impact on the taxability of those benefits

Your circumstances may be considerably different from those described in the scenario. Nevertheless, you may be able to apply the principles to your own situation. A tax professional can help you explore the implications of different withdrawal strategies, help minimize the amount of taxes you pay on hard-earned savings, and, of course, help you maximize your ability to live the retirement you envision.

Monday, June 15, 2015

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, June 12, the S&P 500 closed @ 2094, and that was...

+3.1% ABOVE its 12-Month moving average which stood @ 2031.

+2.0% ABOVE its 40-Week moving average which stood @ 2053.

-0.6% BELOW its 10-Week moving average which stood @ 2107.

Therefore, the INTERMEDIATE-Term trend is NEUTRAL

and the LONG-Term trend is UP.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, June 12, 2015

Wednesday, June 10, 2015

Bull Market Reaches 6 Years and 3 Months...

The ongoing bull market for the S&P 500 reached 75 months in length, or 6 years and 3 months, as of the close of trading on June 09, 2015.

This bull run, the index’s 11th since 1950, is the 3rd bull in the last 65 years to reach 75 months in length.

Monday, June 8, 2015

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, June 5, the S&P 500 closed @ 2094, and that was...

+3.1% ABOVE its 12-Month moving average which stood @ 2030.

+2.1% ABOVE its 40-Week moving average which stood @ 2051.

-0.5% BELOW its 10-Week moving average which stood @ 2104.

Therefore, the INTERMEDIATE-Term trend is NEUTRAL

and the LONG-Term trend is UP.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, June 5, 2015

Why LA's $15 Minimum Wage Will Really Be $19.28

Read More At Investor's Business Daily:

Why LA's $15 Minimum Wage Will Really Be $19.28

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

Wednesday, June 3, 2015

GDP Declines -0.7% in 1Q 2015

Read More @ Investor's Business Daily:

As Obama's Economy Falls, White House Excuses Boom

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

Monday, June 1, 2015

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, May 29, the S&P 500 closed @ 2107, and that was...

+4.3% ABOVE its 12-Month moving average which stood @ 2020.

+2.8% ABOVE its 40-Week moving average which stood @ 2049.

+0.3% ABOVE its 10-Week moving average which stood @ 2101.

Therefore, the INTERMEDIATE-Term trend is NEUTRAL

and the LONG-Term trend is UP.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Subscribe to:

Posts (Atom)