Tuesday, May 31, 2011

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, May 27, the S&P 500 closed @ 1331, and that was...

+6.8% ABOVE its 12-Month moving average which stood @ 1246.

+6.2% ABOVE its 40-Week moving average which stood @ 1253.

-0.2% BELOW its 10-Week moving average which stood @ 1334.

Therefore, the INTERMEDIATE-Term trend IS NEUTRAL and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, May 27, 2011

The National Debt and Diminishing Returns...

The blue line in the chart represents the Total DEBT to GDP.

The green line represents the 10-Year % Change in GDP.

Note that since the 1980s, as debt has soared, GDP growth has suffered.

In the 1950s it took $1.36 in debt to produce $1.00 in GDP.

By the 2000s, it took $5.76 in debt to generate $1.00 in GDP.

Bottom Line:

The more debt we pile on, the more debt it takes to produce increases in GDP.

This immutable relationship between soaring debt and stagnant economic growth is the primary reason why...

"You can't borrow your way to prosperity."

Thursday, May 26, 2011

Survey: Seniors Buying Power Suffers Erosion Since 2000

- +31% — Percentage the Social Security Cost of Living Adjustment has increased.

- +73% — Percentage typical senior expenses have jumped.

- 1 in 3 — Number of beneficiaries who rely on his or her Social Security check for 90% or more of their total income.

Seniors have lost almost one-third of their buying power since 2000, according to the Annual Survey of Senior Costs, released today by The Senior Citizens League, one of the nation's largest nonpartisan seniors advocacy groups.

In most years, seniors receive a small increase in their Social Security checks, intended to help them keep up with the costs of inflation.

But since 2000, the Social Security Cost of Living Adjustment has increased just +31%, while typical senior expenses have jumped +73%, more than twice as fast.

"For many years, seniors have watched helplessly as the value of their benefits has eroded. Those losses have added up, and millions of seniors – among our most vulnerable citizens – are barely able to scrape by today" says Larry Hyland, chairman of The Senior Citizens League.

"To put it in perspective, for every $100 worth of expenses seniors could afford in 2000, they can afford just $68 today."

A senior with an average Social Security benefit in 2000 received $816 per month, a figure that rose to $1,072.30 by 2011. However, that senior would require a Social Security benefit of $1,414.70 per month in 2011 just to maintain a 2000 lifestyle.

A majority of the 37 million Americans aged 65 and over who receive a Social Security check depend on it for at least 50% of their total income, and 1 in 3 beneficiaries rely on it for 90% or more of their total income.

Source: PR Newswire, The Senior Citizens League

Labels:

cost of living,

inflation,

retire,

retirement,

Social Security

Wednesday, May 25, 2011

Seniors's Greatest Fears: Cancer and Alzheimer’s...

41% — Percentage of seniors who fear Cancer the most.

31% — Percentage of seniors who fear Alzheimer's the most.

18% — Percentage of seniors who have made financial arrangements in the event they do become ill with Alzheimer's.

Cancer and Alzheimer’s are the number one and two diseases seniors fear the most, according to a 2010 survey of people 50 and older conducted by MetLife’s Mature Market Institute.

Ranking first was cancer at 41%, followed by Alzheimer’s at 31%. Yet in a telephone survey of roughly 1,000, only 18% said they have made financial arrangements in the event they do become ill with Alzheimer’s. That’s despite the finding that 37% say it’s important to make plans if felled by the disease.

More than 5 million Americans suffer from Alzheimer’s, a number that is expected to grow as baby boomers age, MetLife researchers state.

Rounding out the Top 5 most-feared diseases are: heart disease and stroke (both at 8%) and diabetes (6%).

Source: MetLife’s Mature Market Institute

31% — Percentage of seniors who fear Alzheimer's the most.

18% — Percentage of seniors who have made financial arrangements in the event they do become ill with Alzheimer's.

Cancer and Alzheimer’s are the number one and two diseases seniors fear the most, according to a 2010 survey of people 50 and older conducted by MetLife’s Mature Market Institute.

Ranking first was cancer at 41%, followed by Alzheimer’s at 31%. Yet in a telephone survey of roughly 1,000, only 18% said they have made financial arrangements in the event they do become ill with Alzheimer’s. That’s despite the finding that 37% say it’s important to make plans if felled by the disease.

More than 5 million Americans suffer from Alzheimer’s, a number that is expected to grow as baby boomers age, MetLife researchers state.

Rounding out the Top 5 most-feared diseases are: heart disease and stroke (both at 8%) and diabetes (6%).

Source: MetLife’s Mature Market Institute

Labels:

Alzheimer's,

cancer,

Long-Term Care,

LTC,

LTCI,

retirement,

seniors

Tuesday, May 24, 2011

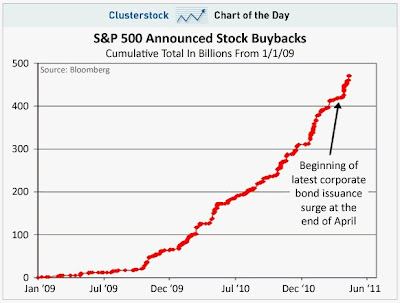

Corporate Stock Buybacks Bullish For Stocks...

Forget fundamentals, here's another reason to be bullish.

WJB Capital Group points out that in just the last few weeks, there's been a massive surge in S&P 500 stock buybacks coinciding with a boom in corporate bond issuance.

In other words, companies continue to take advantage of uber-cheap lending to reduce their share counts.

This is truly a stunning chart!

When buyback announcements hit $100 billion in the last quarter, we pronounced that companies had now put themselves in the driver’s seat in terms of being the major buyer of stocks, just as they did in the last bull market.

In other words, companies continue to take advantage of uber-cheap lending to reduce their share counts.

This is truly a stunning chart!

When buyback announcements hit $100 billion in the last quarter, we pronounced that companies had now put themselves in the driver’s seat in terms of being the major buyer of stocks, just as they did in the last bull market.

And yet, stock investors still don’t want to believe it. Most of Wall Street’s resources go to examining fundamentals or the behavior of other stock investors.

Almost no analysis goes into corporate purchases of stocks, despite their importance.

As a result, with shares set to shrink -5% or more a year, earnings per share estimates three years out may be -15% too low!

Almost no analysis goes into corporate purchases of stocks, despite their importance.

As a result, with shares set to shrink -5% or more a year, earnings per share estimates three years out may be -15% too low!

Monday, May 23, 2011

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, May 20, the S&P 500 closed @ 1333, and that was...

+7.0% ABOVE its 12-Month moving average which stood @ 1246.

+7.0% ABOVE its 40-Week moving average which stood @ 1246.

+0.3% ABOVE its 10-Week moving average which stood @ 1329.

Therefore, the INTERMEDIATE-Term trend IS NEUTRAL and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, May 20, 2011

Chart of The Day: Median Home Prices Still On The Decline...

The U.S. real estate market continues to struggle.

For some perspective, today's top chart illustrates the U.S. median price (adjusted for inflation) of a single-family home over the past 41 years while today's bottom chart presents the annual percent change in home prices (also adjusted for inflation).

Today's chart illustrates that, prior to the financial crisis, the inflation-adjusted median home price rarely declined more than -5% in one year (gray shading).

It is also very important to note that due to a large number of distressed properties, a high unemployment rate and stagnant wages, the inflation-adjusted median home price has declined -7.9% over the past year -- an annual decline larger than any that occurred during the 35 years prior to the financial crisis.

Chart & Commentary Courtesy of Chart of The Day

Labels:

chart of the day,

home,

housing,

real estate

Thursday, May 19, 2011

Wednesday, May 18, 2011

Housing Double Dip Has Officially Arrived...

Unfortunately, it is official.

Home prices have double dipped nationwide, now lower than their March 2009 trough, according to a new report from Clear Capital. It was inevitable that a surge in sales of foreclosed properties and a big push by banks to facilitate short sales would force home prices down dramatically.

Sales of bank-owned (REO) properties hit 34.5% of the market, according to the survey, resulting in a national price drop of -4.9% quarterly and -5% year-over-year. National home prices have fallen -11.5% in the past 9 months, a rate not seen since 2008.

Add short sales, where the bank allows the borrower to sell for less than the value of the mortgage, and prices have nowhere to go but down.

"With more than one-third of national home sales being REO (bank owned), market prices are being weighed down as many markets have not regained enough footing to withstand the strain of the high proportion of REO sales," says Clear Capital's Alex Villacorta.

If prices continue to fall further, which they likely will in the short term, the number of so-called "underwater" borrowers, those with negative equity, will rise even higher, which could in turn result in more loan delinquencies.

Nationwide more than 25% of all homeowners with a mortgage are in a negative equity position, but in some markets, that number is far higher. 46% of Massachusetts borrowers are underwater, according to LendingTree. The last time home prices fell at this rate, 3 years ago, they were then boosted by government stimulus in the form of a home buyer tax credit.

"A note of caution to those looking for a strong end to 2011: The last time no incentives were in place and distressed inventories were this high, home prices fell sharply," warns Villacorta."

Home prices have double dipped nationwide, now lower than their March 2009 trough, according to a new report from Clear Capital. It was inevitable that a surge in sales of foreclosed properties and a big push by banks to facilitate short sales would force home prices down dramatically.

Sales of bank-owned (REO) properties hit 34.5% of the market, according to the survey, resulting in a national price drop of -4.9% quarterly and -5% year-over-year. National home prices have fallen -11.5% in the past 9 months, a rate not seen since 2008.

Add short sales, where the bank allows the borrower to sell for less than the value of the mortgage, and prices have nowhere to go but down.

"With more than one-third of national home sales being REO (bank owned), market prices are being weighed down as many markets have not regained enough footing to withstand the strain of the high proportion of REO sales," says Clear Capital's Alex Villacorta.

If prices continue to fall further, which they likely will in the short term, the number of so-called "underwater" borrowers, those with negative equity, will rise even higher, which could in turn result in more loan delinquencies.

Nationwide more than 25% of all homeowners with a mortgage are in a negative equity position, but in some markets, that number is far higher. 46% of Massachusetts borrowers are underwater, according to LendingTree. The last time home prices fell at this rate, 3 years ago, they were then boosted by government stimulus in the form of a home buyer tax credit.

"A note of caution to those looking for a strong end to 2011: The last time no incentives were in place and distressed inventories were this high, home prices fell sharply," warns Villacorta."

Tuesday, May 17, 2011

Bullish Omen: A New All-Time High for Market Breadth...

When the NYSE Advance/Decline Line makes a multi-year high, stocks tend to do quite a bit better than average in the intermediate- to long-term.

It doesn't mean there won't be any corrections, but the probability of a -10% plus decline during the next 6 months is greatly reduced.

Labels:

advance/decline line,

breadth,

bullish,

omen,

sp 500,

stock market

Monday, May 16, 2011

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, May 13, the S&P 500 closed @ 1338, and that was...

+7.3% ABOVE its 12-Month moving average which stood @ 1247.

+7.9% ABOVE its 40-Week moving average which stood @ 1240.

+0.9% ABOVE its 10-Week moving average which stood @ 1326.

Therefore, the INTERMEDIATE-Term trend IS NEUTRAL to Moderately BULLISH and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, May 13, 2011

A Millionaire Boom Is Coming...

Despite the Great Recession, which wiped out $15.5 trillion in household wealth in the United States alone, the number of millionaires in this country and abroad will grow rapidly over the next decade.

In the U.S., the total number of families with a net worth of over $1 million, including real estate, will double by 2020, according to a report by the Deloitte Center for Financial Services.

Overall, the U.S. and Europe have the greatest concentrations of wealth than any other region, although emerging markets are narrowing the gap.

China will lead the way in millionaire growth, the report said, followed by Brazil and Russia. By 2020, China and South Korea will rank in the top 10 of countries with the greatest total number of families worth more than a million dollars.

"There is going to be very fast growth, but it will take a lot longer to reach anything like the wealth in the developed world," said Andrew Freeman, lead author of the report.

With 10.5 million, the U.S. has -- by far -- the greatest number of millionaire households in the world, despite the financial crisis and ensuing recession which knocked more than 3 million millionaire families off the map between 2006 and 2008.

The number of millionaire households is expected to return to pre-crisis levels by 2015 and reach 20.6 million in 2020, maintaining the U.S.'s position in the top spot. By then, 43% of the world's wealth held by millionaire households will be in the U.S., up slightly from 42% this year, the report said.

Japan is expected to rank a distant 2nd, with 8.6 million millionaire households in 2020 and 9% of the world's wealth. China is expected to be No. 7, with 2.5 million millionaire households in 2020 and 4% of the world's wealth.

Labels:

Brazil,

China,

Europe,

millionaire,

Russia,

South Korea,

U.S.

Wednesday, May 11, 2011

A Failsafe Way To Know If A Recession Is Really On Its Way...

The telltale sign of an impending recession is an inversion (short-term rates are HIGHER than long-term rates) of the 30-year yield vs. the 10-year yield spread.

Historically, the stock market and the economy remain healthy as long as the yield curve is STEEP and NOT inverted.

However, when the yield curve becomes inverted, as it was in 2000 - 2001 and 2007 - 2008 (note the yellow shaded area on graph), the economy and the stock market typically take a bear-market beating within 6 months of the inversion.

Normally, 30-year bonds yield more than 10-year bonds as a function of people wanting to get paid for not being in riskier assets. But when the 30-year yield collapses below the 10-year yield, watch out!

While 30-year yields have been coming down, and the spread is narrowing, we're nowhere near inversion at present.

Labels:

inversion,

inverted,

recession,

steep,

yield curve

Tuesday, May 10, 2011

Chart of The Day: Total Jobs Still Below Level Reached in 2000...

On Friday May 6, the Labor Department reported that nonfarm payrolls (jobs) increased in April for an 8th consecutive monthly gain.

Today's chart provides some perspective on the U.S. job market. Note how the number of jobs steadily increased from 1961 to 2001 (top chart).

During the last economic recovery (i.e. the end of 2001 to the end of 2007), job growth was unable to get back up to its long-term trend (first time since 1961).

More recently, nonfarm payrolls have pulled away from its 40-year trend (1961-2001) by a record percentage (bottom chart).

In fact, the current number of U.S. jobs was first reached in early 2000, more than 10 years ago!

Chart & Commentary Courtesy of Chart of The Day

Today's chart provides some perspective on the U.S. job market. Note how the number of jobs steadily increased from 1961 to 2001 (top chart).

During the last economic recovery (i.e. the end of 2001 to the end of 2007), job growth was unable to get back up to its long-term trend (first time since 1961).

More recently, nonfarm payrolls have pulled away from its 40-year trend (1961-2001) by a record percentage (bottom chart).

In fact, the current number of U.S. jobs was first reached in early 2000, more than 10 years ago!

Chart & Commentary Courtesy of Chart of The Day

Labels:

chart of the day,

jobs,

nonfarm payrolls,

unemployment

Monday, May 9, 2011

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, May 6, the S&P 500 closed @ 1340, and that was...

+7.9% ABOVE its 12-Month moving average which stood @ 1247.

+8.5% ABOVE its 40-Week moving average which stood @ 1235.

+1.2% ABOVE its 10-Week moving average which stood @ 1324.

Therefore, the INTERMEDIATE-Term trend IS BULLISH and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, May 6, 2011

Thursday, May 5, 2011

Retirement Income Percentages - Social Security, Pensions, Savings & Investments, Annuities

- 85% — Percentage of retirees ages 55-79 who are dependent on Social Security.

- 75% — Percentage of retirees who get income from a pension plan.

- 44% — Percentage of retirees who receive income from investments and taxable savings.

- 35% - Percentage of retirees who receive income from annuities.

Labels:

income,

pension,

retire,

retirement,

savings,

Social Security

Wednesday, May 4, 2011

Brace Yourselves for A National Debt Tsunami...

- Our present national debt is $14 trillion.

- The Congressional Budget Office says we will be $20 trillion in debt by 2015, $25 trillion in debt by 2020 and $27 trillion in debt by 2021.

- The interest on $27 trillion would consume 50% of all federal tax revenue.

- By 2026, the rest of the world COMBINED will NOT have enough money available to buy ALL of our debt.

Tuesday, May 3, 2011

Chart of the Day: Gasoline Prices Near Record Highs...

The only time when gasoline prices were higher than today was during a brief 3-month period in mid-2007, just prior to the Great Recession.

Since the financial crisis lows at the end of 2008, the average U.S. price for a gallon of unleaded has risen +$2.18 per gallon.

As a result of ongoing geopolitical tensions as well and increasing global demand, the price of crude oil continues to trend higher.

Over the past 8 months, the cost of one barrel of crude oil has increased by over $40.

With oil prices oil prices trending higher, it is not all that surprising to find that gasoline prices are following suit.

Monday, May 2, 2011

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, April 29, the S&P 500 closed @ 1364, and that was...

+10.9% ABOVE its 12-Month moving average which stood @ 1230.

+11.0% ABOVE its 40-Week moving average which stood @ 1229.

+3.1% ABOVE its 10-Week moving average which stood @ 1322.

Therefore, the INTERMEDIATE-Term trend IS BULLISH and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Subscribe to:

Posts (Atom)