Thursday, June 30, 2011

Why A Portfolio Mix of Stocks & Bonds Is Best...

In the last 30 calendar years (1981-2010), a 70/30 mix of stocks to bonds (with annual rebalancing) produced an average annual total return of +10.5% (before-tax) with the worst year being a -24.3% loss in 2008.

A 100% stock portfolio produced a +10.7% average annual total return (before-tax) with the worst year being a -37.0% loss in 2008.

Thus the stock/bond combination produced 98% of the return of the all-stock portfolio with less volatility.

Source: BTN Research

Labels:

Bonds,

portfolio,

rebalancing,

stocks,

stocks versus bonds

Wednesday, June 29, 2011

Why 2011 May Be A Middling Year...

The S&P 500 enjoyed double digit returns in 2009 and 2010.

A 3rd consecutive year of double-digit gains, however, would be an anomaly.

Since World War II, there have been 10 back-to-back double-digit advances.

Only twice (1951 and 1994) did the streak run to a 3rd year, and the average return in the 3rd year was only +1.7%.

Labels:

historical,

returns,

sp 500,

stock market,

stocks

Tuesday, June 28, 2011

Valuations Hit 26-Year Low As Profits Surge And Stocks Languish

Companies in the S&P 500 Index will earn +18% more in 2011 than in 2010, according to a survey of 9,000 analysts, BUT stock prices are NOT reflecting that rate of growth. The S&P 500 has corrected since April 29 on concerns over China’s slowing economy, the potential Greek default and the end of the Federal Reserve’s $600 billion stimulus program. Negative reports on housing, employment and manufacturing have also sent some investors to the sidelines. As a result, even if companies posted no growth in 2011, price-earnings ratios would be lower than on 96% of days in the past two decades, according to a Bloomberg analysis. |

Monday, June 27, 2011

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, June 24, the S&P 500 closed @ 1268, and that was...

+1.4% ABOVE its 12-Month moving average which stood @ 1251.

-0.3% BELOW its 40-Week moving average which stood @ 1272.

-3.5% BELOW its 10-Week moving average which stood @ 1315.

Therefore, the INTERMEDIATE-Term trend IS BEARISH and the LONG-Term trend is NEUTRAL.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, June 24, 2011

8 Long-Term Care Facts & Fallacies You Need To Know...

- 70% — Percentage of people over the age of 65 who will end up needing long-term care at some point in their lives.

- 54% — Percentage of baby boomers who believe that Medicare covers long-term care. IT DOESN'T!

- 3 Years — Average time frame women over the age of 65 require long-term care, twice as long as men.

- 75% — Percentage of nursing home patients who are women.

- 2x — The rate at which long-term care costs are rising faster than inflation.

- $247 — The average daily cost of daily care in a nursing home with a private room.

- $90,155 — The average annual cost of daily care in a nursing home with a private room.

- $270,465 — The average total cost for 3 years of daily care in a nursing home with a private room.

Labels:

Long-Term Care,

LTC,

LTCI,

retirement,

stats,

women

Thursday, June 23, 2011

Majority of Pre-Retirees Have Saved Less Than $100,000 for Retirement...

63% — Percentage of pre-retirees who said they did NOT feel confident they will be able to live the retirement lifestyle they would like.

55% — Percentage of retirees who have NOT saved enough for retirement — less than $100,000 in household financial assets.

30 million — Number of pre-retirees who have considered the implications of outliving their income.

LIMRA research found almost two-thirds of pre-retiree households, age 55-70, do NOT have a professional financial advisor. However, the majority, 54%, of those who DO work with an advisor feel confident about life after retirement.

“With so much uncertainty in the economy and in the social programs supporting retired Americans, pre-retirees face many challenges when preparing for retirement,” said Marie Rice, corporate vice president and director of LIMRA Retirement Research.

“Our research is clear: Those who use professional financial advisors enjoy the peace of mind that they are making the appropriate decisions to ensure they have a financially secure retirement.”

“Retirement planning involves many complicated decisions that should not be done without the knowledge and expertise that a professional financial advisor can provide,” commented Rice.

“Pre-retirees who use this help to make these critical decisions are more confident that they made the right choices.”

Source: LIMRA

55% — Percentage of retirees who have NOT saved enough for retirement — less than $100,000 in household financial assets.

30 million — Number of pre-retirees who have considered the implications of outliving their income.

LIMRA research found almost two-thirds of pre-retiree households, age 55-70, do NOT have a professional financial advisor. However, the majority, 54%, of those who DO work with an advisor feel confident about life after retirement.

“With so much uncertainty in the economy and in the social programs supporting retired Americans, pre-retirees face many challenges when preparing for retirement,” said Marie Rice, corporate vice president and director of LIMRA Retirement Research.

“Our research is clear: Those who use professional financial advisors enjoy the peace of mind that they are making the appropriate decisions to ensure they have a financially secure retirement.”

“Retirement planning involves many complicated decisions that should not be done without the knowledge and expertise that a professional financial advisor can provide,” commented Rice.

“Pre-retirees who use this help to make these critical decisions are more confident that they made the right choices.”

Source: LIMRA

Wednesday, June 22, 2011

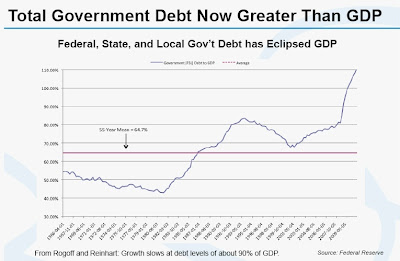

Total Government Debt Now Greater Than GDP...

- The 15-year average debt level is 65% of GDP.

- Economic growth begins to slow at debt levels of about 90% of GDP.

- Currently, total government debt is at 110% of GDP.

- This does not bode well for the future of America.

Tuesday, June 21, 2011

A New High In Negative Equity for Single Family Homes...

Recently, Zillow.com reported a new high in negative equity: 28.4% of single family homes with a mortgage (remember, 32% of all homeowners do not have a mortgage).

That's a national average, but the numbers are far worse in some of the nation's big metros. Atlanta, for example, has a 55.7% negative equity rate. Denver, 41%, Chicago nearly 46%.

"Higher rates of negative equity are creating a lot of latent vulnerability in the housing stock, where if the household then encounters some economic shock, like the loss of a job or divorce or death, then that household is much, much more likely to go into foreclosure," notes Zillow's Stan Humphries.

"So it just means that higher rates of negative equity, we’re going to see elevated rates of foreclosure for the next two to three years."

But higher rates of foreclosure put increasing pressure on home prices, causing them to fall further, which in turn puts even more borrowers underwater.

A vicious downward cycle where one begets the other, begets the other.

"The best research that’s been done right now seems to suggest that negative equity impact on strategic defaults really kicks in at very high rates of value to loan ratio, so that means when people are more like 30-40% underwater does it start to create proactive behavior where they want to walk away from the mortgage. And even at those rates of loan to values, you’re still seeing strategic defaults be a relative…not a majority behavior," says Humphries.

"Home buyer confidence and demand are the only remedies right now for the housing/foreclosure crisis. Sadly, we have neither."

Monday, June 20, 2011

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, June 17, the S&P 500 closed @ 1272, and that was...

+1.6% ABOVE its 12-Month moving average which stood @ 1252.

+0.4% ABOVE its 40-Week moving average which stood @ 1267.

-3.7% BELOW its 10-Week moving average which stood @ 1321.

Therefore, the INTERMEDIATE-Term trend IS BEARISH and the LONG-Term trend is Moderately BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, June 17, 2011

How Manufacturing Productivity Has Improved Our Lives...

The chart above displays the share of Personal Consumption Expenditures represented by 3 categories of manufactured consumer goods that are most important to U.S. households:

a) food and beverages consumed at home

b) clothing and footwear

c) furnishings and durable household equipment

In the late 1940s, it required almost half (41%) of consumer expenditures to provide for the household basics: food, clothing and home furnishings, which are all manufactured goods.

For every $100 of consumer spending today, only $13.50 is spent on food, clothing and household furnishings and $87.50 is spent on everything else. Contrast that to 1948, when it took $40 of every $100 of spending for the basics, leaving only $60 to spend on all other goods and services.

Bottom Line:

Without the major productivity gains in the manufacturing sector over the last 50 years, it would still require almost half of consumer spending just to furnish our houses, and feed and clothe our families.

The standard of living for the average American household has improved significantly over the last 50 years, and keeps getting better all the time, thanks in large part to greater manufacturing productivity.

Chart and Commentary Courtesy of

CARPE DIEM

Professor Mark J. Perry's Blog for Economics and Finance

Thursday, June 16, 2011

Greece. The Lowest "Rated" Sovereign Debt Nation In The World....

Greece is now the lowest rated country in the S&P debt rating universe, below that of Jamaica, Pakistan and Ghana and below Argentina and Ecuador, which have recently defaulted on their debt.

S&P doesn't rate every country, so some likely have worse credit profiles than Greece.

S&P doesn't rate every country, so some likely have worse credit profiles than Greece.

Wednesday, June 15, 2011

Long-Term Care Buyer's Prefer Limited-Duration Policies...

- 57.1% — Percentage of LTCI buyers who selected policies with a benefit period of 4 years or less.

- 80.7% — Percentage of LTCI buyers who were under the age of 65.

- 56.0% — Percentage of LTCI buyers who were between the ages of 55-64.

"Limited duration policies continue to become the preferred choice of many consumers who benefit from their lower cost and are willing to assume some of the risk for a catastrophic long-term care event," states Jesse Slome, AALTCI's executive director.

"Given the economic uncertainty of the past few years, it is understandable that consumers favor ways to reduce the cost of coverage that, while important, is still a discretionary purchase," Slome notes.

"In addition, newer product design features such as the "shared care" option allow couples to purchase more affordable limited-duration policies and still be protected if one spouse requires care for longer than provided by their own policy."

According to the AALTCI, more than 75% of individual long-term care insurance policies are purchased by couples.

Tuesday, June 14, 2011

Rising Oil Consumption in the Emerging Markets Will Persist...

Western Europe, France, Japan, Norway and the U.K. all use less oil on a per capita basis than they did in the 1970s.

This trend is why emerging countries, especially Asia, will be the epicenter of oil demand growth for years to come.

Monday, June 13, 2011

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, June 10, the S&P 500 closed @ 1271, and that was...

+1.5% ABOVE its 12-Month moving average which stood @ 1252.

+0.6% ABOVE its 40-Week moving average which stood @ 1263.

-4.1% BELOW its 10-Week moving average which stood @ 1326.

Therefore, the INTERMEDIATE-Term trend IS BEARISH and the LONG-Term trend is Moderately BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, June 10, 2011

Thursday, June 9, 2011

S&P 500 Year-End Price Targets - The Range is 1238 to 1550...

The S&P 500 closed at 1,258 at the end of 2010.

By year-end 2011, a S&P close of 1,238 (the lowest target) would represent a -1.6% decline.

An advance to 1,550 (the highest target) translates to a +23.3% gain for 2011.

The average of all targets is 1,402, which would represent an +11.5% advance.

Wednesday, June 8, 2011

American Incomes Not Keeping Pace with The Cost of Living

No matter which inflation metric is used, the average worker's income is not keeping up with the cost of living.

Census Bureau data shows the median or typical household has experienced an inflation adjusted decline of -5% in household income since 1999.

During the 1960's and the first half of the 1970's, 77% of consumption in the U.S. was financed by wage and salary income, according to the Commerce Department. Since then, it has drifted down to just 64% in 2010.

Census Bureau data shows the median or typical household has experienced an inflation adjusted decline of -5% in household income since 1999.

During the 1960's and the first half of the 1970's, 77% of consumption in the U.S. was financed by wage and salary income, according to the Commerce Department. Since then, it has drifted down to just 64% in 2010.

Household debt as a percent of GDP soared from 44% in 1982 to 98% in 2007.

The increase in consumption was also funded by a significant increase in government-backed income transfers (unemployment benefits, social security, disability insurance, Medicare, Medicaid, veteran's benefits, etc) from just 8% in 1970 to almost 18% in 2010.

If it wasn't for the almost $1 trillion in government income transfers made possible by increasing federal debt by +$1 trillion since December 2007, disposable income would be -4.6% lower, rather than up +4.0%!

Source: Anchor Capital

The increase in consumption was also funded by a significant increase in government-backed income transfers (unemployment benefits, social security, disability insurance, Medicare, Medicaid, veteran's benefits, etc) from just 8% in 1970 to almost 18% in 2010.

If it wasn't for the almost $1 trillion in government income transfers made possible by increasing federal debt by +$1 trillion since December 2007, disposable income would be -4.6% lower, rather than up +4.0%!

Source: Anchor Capital

Tuesday, June 7, 2011

Seniors and Savers Victims of Plunging Safe Money Rates...

According to the Labor Department, there are 24.6 million households headed by people aged 65+ and older.

Most of these folks spent their lives working, raising families, and saving a little from their paychecks. They are risk adverse and dependent on the income from Certificates of Deposits and money market funds.

As of January, the average interest rate paid on these relatively safe vehicles was 0.24%, the lowest on record dating back to 1959.

Americans have $3 trillion in money market funds and $5 trillion in savings accounts. Compared to 2007, the loss of interest income amounts to $350 billion a year, according to Crane Data.

One-year CD rates have plunged during the last 3 years from 3.63% to 0.53%, and Bankrate.com estimates this translates into a loss of $41 billion a year for savers.

Most of these folks spent their lives working, raising families, and saving a little from their paychecks. They are risk adverse and dependent on the income from Certificates of Deposits and money market funds.

As of January, the average interest rate paid on these relatively safe vehicles was 0.24%, the lowest on record dating back to 1959.

Americans have $3 trillion in money market funds and $5 trillion in savings accounts. Compared to 2007, the loss of interest income amounts to $350 billion a year, according to Crane Data.

One-year CD rates have plunged during the last 3 years from 3.63% to 0.53%, and Bankrate.com estimates this translates into a loss of $41 billion a year for savers.

Source: Anchor Capital

Monday, June 6, 2011

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, June 3, the S&P 500 closed @ 1300, and that was...

+3.5% ABOVE its 12-Month moving average which stood @ 1256.

+3.3% ABOVE its 40-Week moving average which stood @ 1259.

-2.4% BELOW its 10-Week moving average which stood @ 1332.

Therefore, the INTERMEDIATE-Term trend IS NEUTRAL to Moderately Bearish and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, June 3, 2011

The Majority Will Require Some Form of Long-Term Care...And It Won't Come Cheap

First, according to the American Association for Long-Term Care Insurance (AALTCI), women are far more likely than men to require care.

Nearly 75% of nursing home residents are women, and women older than age 65 require care for an average of 3 years, roughly twice that of men.

Therefore, it is not surprising that a significant number of long-term care recipients (66%) are women.

Single women represent the largest block of claimants (41%), while single men comprise the smallest (12%).

Finally, AALTCI estimates that women provide upwards of 60% of care needed for a spouse or family member, frequently while continuing to take care of their children and job obligations.

Labels:

Long-Term Care,

LTC,

LTCI,

retirement,

women

Thursday, June 2, 2011

Average Hourly Earnings on A Flat to Downward Trajectory...

Is this graph is indicative of economic prosperity?

Not for the purchasing power of the average consumer.

Labels:

earnings,

income,

purchasing power,

recovery

Wednesday, June 1, 2011

Chart of The Day: Currency Debasement Is as Old as The Roman Empire...

People who focus on the decline and fall of the dollar are really into passing this chart around.

It shows, basically, that currency debasement is as old as currency itself, as the Romans gradually chipped away at the amount of silver in their coins.

The further lesson, from history, apparently, is that in addition to currency debasement being a characteristic of great empires, total collapse is, too.

Let's hope not.

Chart and Commentary Courtesy of BusinessInsider.com

Subscribe to:

Posts (Atom)