Monday, January 30, 2017

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, January 27, the S&P 500 closed @ 2294, and that was...

+6.3% ABOVE its 12-Month moving average which stood @ 2158.

+6.3% ABOVE its 40-Week moving average which stood @ 2158.

+2.2% ABOVE its 10-Week moving average which stood @ 2244.

Therefore, the INTERMEDIATE-Term trend is BULLISH

and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, January 27, 2017

Tips for Deducting More at Tax Time

Tax Deductions come in two basic types:

“Above-the-Line” and “Below-the-Line.”

The “Line” is your Adjusted Gross Income, or AGI.

Above-the-Line deductions are subtracted from your total income, thus lowering your AGI.

Another advantage is that many “Above-the-Line” deductions are allowed under the Alternative Minimum Tax, or AMT.

A lower AGI can potentially increase the value of your Below-the-Line itemized deductions, which often come with limits.

For example, you can deduct your medical and dental expenses, but only the amount that exceeds 10% of your AGI (7.5% if you or your spouse is 65 or older) and only if you itemize deductions on your federal tax return.

So the lower your AGI, the quicker you hit 10% and can start deducting.

You can’t claim these expenses if you take the standard deduction which, for 2016, is $6,300 for taxpayers who are single or married filing separately, $12,600 for married filing jointly, and $9,300 for heads of household (single taxpayers with dependents).

Labels:

Adjusted,

AGI,

Alternative Minimum Tax,

Gross Income,

income tax,

taxation,

taxes

Wednesday, January 25, 2017

Monday, January 23, 2017

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, January 20, the S&P 500 closed @ 2271, and that was...

+5.4% ABOVE its 12-Month moving average which stood @ 2154.

+5.4% ABOVE its 40-Week moving average which stood @ 2154.

+1.3% ABOVE its 10-Week moving average which stood @ 2243.

Therefore, the INTERMEDIATE-Term trend is BULLISH

and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, January 20, 2017

Wednesday, January 18, 2017

Monday, January 16, 2017

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, January 13, the S&P 500 closed @ 2275, and that was...

+5.6% ABOVE its 12-Month moving average which stood @ 2155.

+5.8% ABOVE its 40-Week moving average which stood @ 2150.

+1.9% ABOVE its 10-Week moving average which stood @ 2232.

Therefore, the INTERMEDIATE-Term trend is BULLISH

and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, January 13, 2017

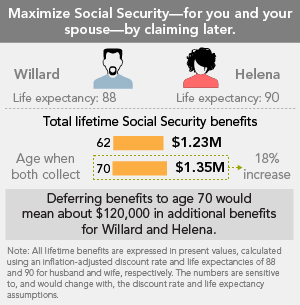

Social Security: Strategy #1: Maximize Lifetime Benefits

| Strategy No. 1: | Maximize Lifetime Benefits. |

A couple with similar incomes and ages may maximize lifetime benefits if both delay.

How it works: The basic principle is that the longer you defer your benefits, the larger they grow. Each year you delay Social Security from age 62 to 70 could increase your benefit by up to +8.0%.

Whom it may benefit: This strategy works best for couples with normal to high life expectancies with similar earnings, who are planning to work until age 70 or have sufficient savings to provide any needed income during the deferral period.

Example: Willard’s life expectancy is 88, and his income is $75,000. Helena’s life expectancy is 90, and her income is $70,000. They enjoy working. Suppose Willard and Helena both claim at age 62. As a couple, they would receive a lifetime benefit of $1,230,000. But if they live to be ages 88 and 90, respectively, deferring to age 70 would mean about $120,000 in additional benefits.

Learn More...

Read Viewpoints: “How the get the most from Social Security."- Watch Learning Center Video: Social Security: 5 key considerations to know before claiming your benefit.

- Visit the SSA website

to request your Social Security statement, calculate your FRA, or estimate your future retirement, disability, or survivor benefits. You can also get additional information in the FAQ section

to request your Social Security statement, calculate your FRA, or estimate your future retirement, disability, or survivor benefits. You can also get additional information in the FAQ section .

. - Enter your estimated Social Security benefit information into the Fidelity Planning & Guidance Center to see how Social Security fits with your overall retirement plan.

Labels:

benefits,

claiming strategies,

Social Security

Wednesday, January 11, 2017

Monday, January 9, 2017

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, January 6, the S&P 500 closed @ 2277, and that was...

+5.7% ABOVE its 12-Month moving average which stood @ 2155.

+6.2% ABOVE its 40-Week moving average which stood @ 2144.

+2.9% ABOVE its 10-Week moving average which stood @ 2213.

Therefore, the INTERMEDIATE-Term trend is BULLISH

and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, January 6, 2017

Wednesday, January 4, 2017

Monday, January 2, 2017

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, December 30, the S&P 500 closed @ 2239, and that was...

+5.0% ABOVE its 12-Month moving average which stood @ 2133.

+4.7% ABOVE its 40-Week moving average which stood @ 2139.

+1.9% ABOVE its 10-Week moving average which stood @ 2198.

Therefore, the INTERMEDIATE-Term trend is BULLISH

and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Subscribe to:

Posts (Atom)