Ben Franklin said that in

this world nothing is certain but death and taxes. Well, one product sits at

the intersection of both—life insurance. It may not help you cheat death, but

it may help manage taxes.

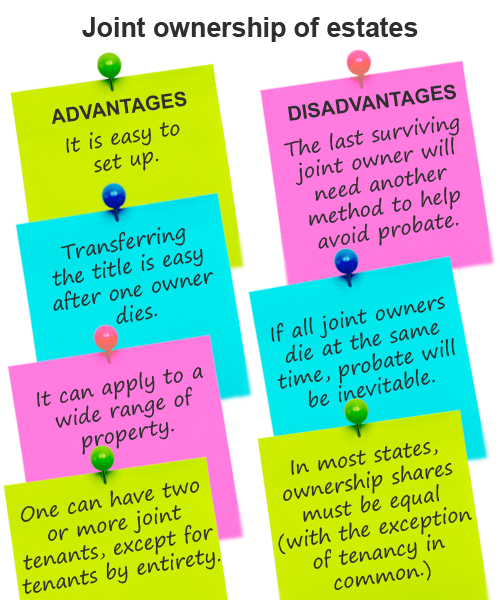

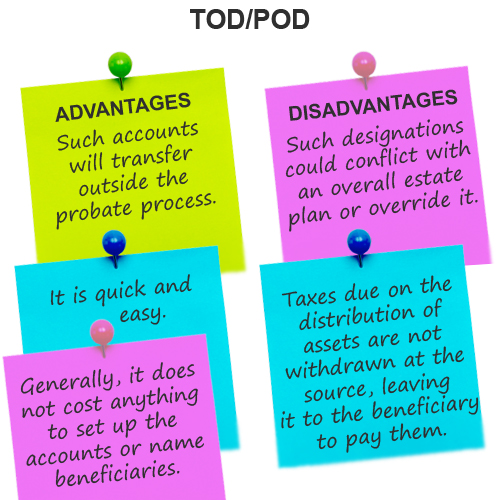

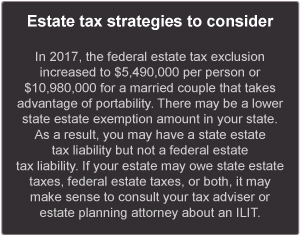

There are certain estate planning steps we should all take, including the creation of a will and a health care directive. But if you have enough wealth that you expect your estate to be taxed—at either the state or the federal level—you may want to consider more advanced strategies, including using life insurance in a trust.

Irrevocable Life Insurance Trust

✔ May provide cash for heirs to settle estate.

✔ Death benefit is generally not considered taxable income by the IRS.

✔ Choose an insurer with a strong rating.

✔ It is a complex legal arrangement requiring properly drafted documentation.

✔ Consult a legal advisor regarding your specific situation.

https://www.fidelity.com/viewpoints/personal-finance/can-life-insurance-help