Thursday, March 31, 2011

Wednesday, March 30, 2011

The Primary Retirement Concerns for Seniors...

A retirement planning survey by the Illinois-based Society of Actuaries finds the main retirement concerns seniors have are...

1) Keeping the value of investments up with inflation

2) The effect of interest rates on income

3) The affordability of health care and long-term care

4) Outliving assets

5) Maintaining a reasonable standard of living

Other findings include...

80% — Percentage of those who do NOT look ahead more than 20 years when making important financial decisions, and only 5% look to or beyond their life expectancy.

68% — Percentage of retirees who have created a plan to manage their money each year to avoid outliving their finances.

73% — Percentage of retirees who have considered allocating their investments and savings to different types of assets. Just 24% of retirees, however, have purchased or plan to buy any guaranteed income products.

Source: Senior Housing News

1) Keeping the value of investments up with inflation

2) The effect of interest rates on income

3) The affordability of health care and long-term care

4) Outliving assets

5) Maintaining a reasonable standard of living

Other findings include...

80% — Percentage of those who do NOT look ahead more than 20 years when making important financial decisions, and only 5% look to or beyond their life expectancy.

68% — Percentage of retirees who have created a plan to manage their money each year to avoid outliving their finances.

73% — Percentage of retirees who have considered allocating their investments and savings to different types of assets. Just 24% of retirees, however, have purchased or plan to buy any guaranteed income products.

Source: Senior Housing News

Labels:

health care,

health insurance,

housing,

inflation,

LTC,

LTCI,

retirement,

seniors

Tuesday, March 29, 2011

The So-Called Housing Recovery Is A Mirage...

How can anyone really be talking about a normal recovery when housing is still in depression?

Let’s talk about normal. What’s normal is that at this stage of the post-recession recovery, new home sales would have risen +27% from the time the expansion began ― not having sagged -37% to fresh all-time lows.

The big news was on pricing. No matter how far the builders cut production, demand continues to recede at even a faster rate. Median new home prices slid -13.9% month over month, following a -0.8% decline in January, taking them to $202,100 ― the lowest they have been since December 2003.

This may not be deflation as far as consumer prices go, but it is serious deflation on the most critical part of the household balance sheet. And sadly, more deflation is very likely on its way.

Chart and Commentary Courtesy of David Rosenberg of Gluskin Sheff

Monday, March 28, 2011

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, March 25, the S&P 500 closed @ 1314, and that was...

+9.1% ABOVE its 12-Month moving average which stood @ 1204.

+9.9% ABOVE its 40-Week moving average which stood @ 1195.

+0.4% ABOVE its 10-Week moving average which stood @ 1308.

Therefore, the INTERMEDIATE-Term trend IS NEUTRAL and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, March 25, 2011

Ugh. Technology and Financials Have Yet to Recapture Their 2000 Bull Market Peaks

According to Sam Stovall, Chief Investment Analyst with Standard & Poor's, talking with Maria Bartiromo on CNBC on 03/21/2011:

Since the Technology Crash of 2000 (03/24/00):

- The technology sector is still down today by -60% from the 03/24/00 highs.

- The telecom sector is still down today by -60% from the 03/24/00 highs.

- The financial sector is still down today by -55% from the 03/24/00 highs.

- The Nasdaq is still down today by -43% from the 03/24/00 highs.

In the 34-month bear market following the 03/24/00 tech boom:

- The technology sector melted down -82%.

- The telecom sector crumbled -73%.

Since the stock market crash starting 10/12/2007:

- The financial sector is still down by -83%.

Thursday, March 24, 2011

Sobering Stats on Americans Age 45 and Older...

AARP’s Closer Look Survey conducted in November of last year reveals the financial affect that social and economic changes and issues have on Americans age 45 and older. Some key findings were:

22% of those 45 and older said their work hours were cut, took a pay cut, or lost other types of work-related income.

28% of those aged 45-64 lost work-related income, compared to 9% of those 65 and older. The number of those who said they had a loss of work-related income has increased 5 percentage points since November 2009.

42% of respondents 45 and older reported having hardship related to health care, such as trouble paying medical bills, putting off needed care or not getting prescriptions refilled or resorting to splitting pills.

57% of African-American and 52% of Hispanic adults 45 and older reported having health care-related hardships, compared to 40% of whites.

57% of those with hardships have had to withdraw or stop contributing to their retirement savings also reported health care-related hardships, compared to 26% who did not.

Source: AARP

Labels:

health care,

income,

retire,

retirement,

stats

Wednesday, March 23, 2011

10 Essential Questions Retirees MUST Address With Their Advisor...

1. What are you currently doing in preparation for your financial future?

2. What do you like most about your financial situation?

3. What don't you like about your current financial position?

4. As you reassess your planning process, what kinds of improvements are you looking to make?

5. Describe the ideal financial professional or financial strategy?

6. What has been your past experience with preparing for you financial future?

7. What, ideally, would you like to accomplish with your financial strategy?

8. What other family members need to be involved or consulted in the decision-making process?

9. Where does leaving a financial legacy for future generations rank in your list of priorities?

10. What, if anything, keeps you up at night?

Tuesday, March 22, 2011

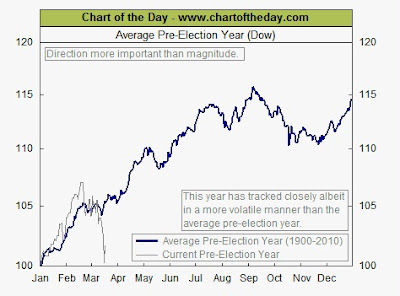

Chart of The Day - Average Pre-Election Year - Is 2011 Keeping Historical Pace?

Today's chart illustrates how the stock market has performed during the average pre-election year.

Since 1900, the stock market has tended to perform well during the first seven to eight months of the average pre-election year. For the remainder of the year, pre-election performance has tended to be more flat/choppy. In the end, however, the stock market has tended to outperform during the entirety of the pre-election year.

This pre-election year has followed the path of the average pre-election year rather closely with a rally up until mid-February and a correction into mid-March with the aftermath of the devastating Japanese earthquake and tsunami weighing heavily on the market over the past few days.

Since 1900, the stock market has tended to perform well during the first seven to eight months of the average pre-election year. For the remainder of the year, pre-election performance has tended to be more flat/choppy. In the end, however, the stock market has tended to outperform during the entirety of the pre-election year.

This pre-election year has followed the path of the average pre-election year rather closely with a rally up until mid-February and a correction into mid-March with the aftermath of the devastating Japanese earthquake and tsunami weighing heavily on the market over the past few days.

Labels:

chart of the day,

election,

historical,

pre-election,

Presidential Cycle

Monday, March 21, 2011

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, March 18, the S&P 500 closed @ 1279, and that was...

+6.7% ABOVE its 12-Month moving average which stood @ 1199.

+7.5% ABOVE its 40-Week moving average which stood @ 1190.

-2.1% BELOW its 10-Week moving average which stood @ 1306.

Therefore, the INTERMEDIATE-Term trend IS NEUTRAL to Moderately Bearish and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, March 18, 2011

How An Immediate Annuity Could Save Your Retirement Plan...

According to Financial Research Corp., a Boston research firm, a 65-year-old retiree who withdraws an inflation-adjusted $45,000 annually from a $1 million portfolio of stock and bond investments has a 25% chance of running out of money before age 92.

But if the retiree gets the same annual income by investing $400,000 in an immediate annuity and withdrawing the rest from $600,000 invested in stocks and bonds, the chance of running out of money drops to only 6%, the research firm says.

According to actuarial mortality tables, a healthy 65-year-old man has a 33% chance and a healthy woman a 44% chance of living beyond 90.

For a 65-year-old couple, there's more than a 50% chance that at least one of them will live beyond 90.

Labels:

annuities,

annuity,

immediate,

mortality,

retirement

Thursday, March 17, 2011

Corporate Cash At A 50-Year High...

The cash and other liquid assets held by nonfinancial U.S. corporations has hit its highest level since 1963, which is a good news / bad news situation.

Nonfinancial companies are holding $1.9 trillion in cash, or 7% of all their assets, which is the highest level since 1963, according to the Wall Street Journal.

On the one hand, that’s a very healthy development as it reflects a successful round of cost-cutting and higher profits in reaction to the economic crisis.

On the other hand, it implies a troubling lack of confidence in the recovery, since these assets are not being deployed for hiring and expansion purposes.

Wednesday, March 16, 2011

Housing Double Dip?

Home prices are at near their post-bust lows. January saw a double-digit dip in the number of new homes sold. Then Robert Shiller, Yale economist and co-founder of the S&P/Case-Shiller home price indexes, dropped this bomb: "There's a substantial risk of home prices falling another -15%, -20% or -25%," he said.

Besides, a home purchase is more than a potential investment, especially for families planning to stay put for a while. The big plus for them is the pleasure of living in their own homes. "People should base their decision on affordability, lifestyle choices and home preferences, not on investment," said Lawrence Yun, the National Association of Realtors' chief economist.

Buyers may take heart from some positive recent indicators, such as an up tick in the sales of existing homes in January; a drop in vacant rental homes; and more investors snapping up properties.

There's also been an upswing in the number of high-end homes -- those costing more than $750,000 -- being sold, according to Yun. The wealthy buyers of these properties have lots of choices of where to place their money and many are investing in real estate. "The smart money is making their move," said Yun.

Tuesday, March 15, 2011

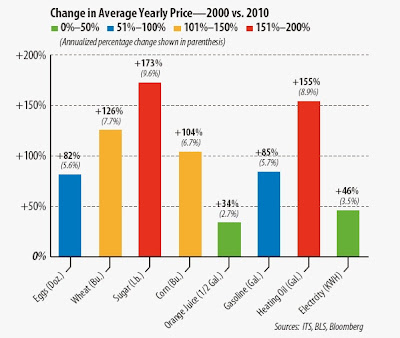

The Inflation Rate Is Only 1.2%? Say What?

"The inflation rate right now is 1.2% for all goods and services."

-Federal Reserve Chairman, Ben Bernacke, in testimony before the U.S. House Financial Services Committee, March 2, 2011.

According to a recent article on CNNMoney.com, the Fed is currently projecting inflation of less than +2% for each of the next 3 years. Really?

The bar chart above shows the change in the price of several commodities from 2000 to 2010. The majority, if not all of which would be considered by many American's to be "staple" items.

For the group as a whole, the average price increase was more than +100% for the 10-year period, which was an annual increase of about +6.5% per year, more than twice the annual inflation increase the U.S. government has been reporting for the same period!

Has the government been under reporting the inflation figures for the past 10 years? Do you believe that inflation is really running under +2%? The government couldn't be misleading us, could they?

Monday, March 14, 2011

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, March 11, the S&P 500 closed @ 1304, and that was...

+8.4% ABOVE its 12-Month moving average which stood @ 1203.

+10.0% ABOVE its 40-Week moving average which stood @ 1186.

-0.1% BELOW its 10-Week moving average which stood @ 1305.

Therefore, the INTERMEDIATE-Term trend IS NEUTRAL and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, March 11, 2011

This Bull Market Is Lagging The Typical Bull Market By A Healthy Margin...

Even after almost doubling in 24 months, the S&P 500's two-year return is still -36% below the average bull-market gain of +131% since 1962, according to data compiled by Bloomberg and Birinyi Associates.

The 730-day rally without a decline of -20% or more compares with an average duration of 1,407 days before a decline of -20%, the data show.

Thursday, March 10, 2011

How U.S. Oil Consumption Compares to China's...

The U.S. consumes +21.7% of the world's daily oil production, more than double the +10.4% consumed by China.

The USA's population is 311 million. China's population is 1.319 billion or 1 billion greater than the USA.

Source: British Petroleum

Wednesday, March 9, 2011

The S&P 500: Bull Market Duration Perspectives...

7 of the last 10 bull markets for the S&P 500 stock index have reached at least 3-years in length and 5 of the 10 lasted at least 5 years.

The current bull market is the 11th bull for the S&P 500 since 1949 and it will mark 2-years in length on March 9, 2011.

Source: BTN Research

Tuesday, March 8, 2011

U.S Health Care vs. Socialized Medicine in Canada and England...

A recent "Investor's Business Daily" article provided very interesting statistics from a survey by the United Nations International Health Organization.

Percentage of men and women who survived a cancer five years after diagnosis:

U.S. 65%

England 46%

Canada 42%

Percentage of patients diagnosed with diabetes who received treatment within six months:

U.S. 93%

England 15%

Canada 43%

Percentage of seniors needing hip replacement who received it within six months:

U.S. 90%

England 15%

Canada 43%

Percentage referred to a medical specialist who see one within one month:

U.S. 77%

England 40%

Canada 43%

Number of MRI scanners (a prime diagnostic tool) per million people:

U.S. 71%

England 14%

Canada 18%

Percentage of seniors (65+), with low income, who say they are in"excellent health":

U.S. 12%

England 2%

Canada 6%

Hmm. No contest. The USA's private system wins hands down in every category.

What's so great about socialized medicine?

Percentage of men and women who survived a cancer five years after diagnosis:

U.S. 65%

England 46%

Canada 42%

Percentage of patients diagnosed with diabetes who received treatment within six months:

U.S. 93%

England 15%

Canada 43%

Percentage of seniors needing hip replacement who received it within six months:

U.S. 90%

England 15%

Canada 43%

Percentage referred to a medical specialist who see one within one month:

U.S. 77%

England 40%

Canada 43%

Number of MRI scanners (a prime diagnostic tool) per million people:

U.S. 71%

England 14%

Canada 18%

Percentage of seniors (65+), with low income, who say they are in"excellent health":

U.S. 12%

England 2%

Canada 6%

Hmm. No contest. The USA's private system wins hands down in every category.

What's so great about socialized medicine?

Monday, March 7, 2011

Vantage Point UPDATE: Intermediate-Term and Long-Term Trend Analysis

On Friday, March 4, the S&P 500 closed @ 1321, and that was...

+9.5% ABOVE its 12-Month moving average which stood @ 1206.

+12.0% ABOVE its 40-Week moving average which stood @ 1180.

+1.5% ABOVE its 10-Week moving average which stood @ 1301.

Therefore, the INTERMEDIATE-Term trend IS BULLISH and the LONG-Term trend is BULLISH.

Labels:

intermediate-term,

long-term,

trend,

Vantage Point

Friday, March 4, 2011

The Economy: The Good, The Bad and The Ugly...

The Good: The manufacturing data in the U.S. continues to improve, at least within the confines of the major diffusion indices.

The Bad: The U.S. income and spending numbers were hardly stellar. It remains to be seen how much of the weakness was weather-related, but consumer spending dipped -0.1% in January - the first decline since April 2010. The fact is that consumers kept a lid on their spending even with the fiscal windfall in January, pushing the savings rate up to a four-month high of 5.8% from 5.4% in both November and December.

The Ugly: The housing sector remains in the dumpster.

Source: "The Good, The Bad and The Ugly" by David Rosenberg of Gluskin Sheff

Thursday, March 3, 2011

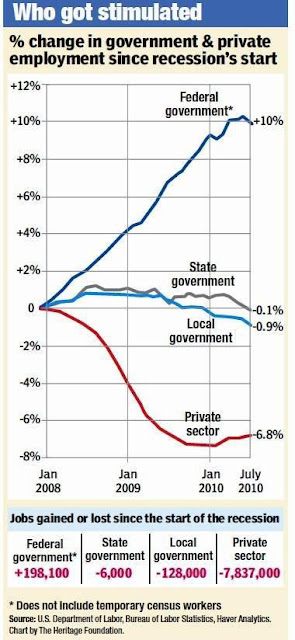

Why The Washington D.C. Metro Area Has The Highest Per Capita Income In The Country...

Since the recession started private employment has declined by nearly -7% , a total of nearly -8 million jobs lost.

State and Local government employment, however, is essentially unchanged.

But Federal government employment has increased roughly +10%!

So that's where all that stimulus money went! To stimulate government, not the private sector?

Is that the reason why the Washington D.C. metro area (including suburban Maryland and Virginia) has the highest per capita income and lowest unemployment rate in the entire nation?

Wednesday, March 2, 2011

U.S Dollar - Safe Haven No More?

For years, whenever significant political or financial turmoil reared its head anywhere on the globe, investors would turn to the U.S. dollar as a safe haven.

Yet as the chaos in North Africa has grown over the past month, investors have largely shunned the dollar and sought shelter elsewhere. They have turned to other traditional islands of stability, buying Japanese yen and the Swiss franc.

What has especially raised eyebrows has been the move by investors to buy euros, a currency traditionally seen as a riskier prospect than the dollar, especially with the euro zone's debt problems still largely unresolved.

This has sparked a debate over whether the dollar has lost its safe-haven status.

"Over the last 20 years, people have always moved into the dollar on any sort of uncertainty in the global economic space, but what we've seen over the past two weeks is actually a terrific move out of the dollar," says Douglas Borthwick, a managing director at Faros Trading in Stamford, CT...

So for now, the argument goes, there are better safe havens available to investors than the U.S. currency.

Even on individual days when events have sent a scare through the financial markets, the dollar hasn't benefited.

On January 25, when the protests in Egypt first flared up, the euro advanced more than two cents to almost $1.39.

This contrasts with other episodes of flight-to-safety currency buying in the past. During the 2008 global financial crisis, the dollar rose by roughly +24%.

Analysts at BCA Research also point out that some investors also are looking to gold as a more appealing safe-haven investment. "We would agree with this assessment," the analysts wrote.

Gold rose +5.7% in February, its biggest monthly gain since April 2010. With investors increasingly wary of the ability of the U.S. to solve its fiscal problems and the Fed perceived to be "printing dollars" as part of its quantitative-easing strategy to support the economy, there's less confidence that the U.S. dollar is "safe" in the sense, Mr. Borthwick says.

"It's the knee-jerk reaction that matters," he said. "Nowadays the knee-jerk reaction is buy euros and not to buy dollars. The mindset of buying euros is a complete switch."

Source: Wall Street Journal

Tuesday, March 1, 2011

Chart of The Day: Why The World Has No Choice But To Buy More And More Fertilizer

Why is everyone crazy about fertilizer and potash stocks?

One part of the equation is that demand for food is growing.

But there's another reason:

The clear trend in major regions is for less and less arable land per capita. Thus the only way to get more food is to get more yield from diminishing acres.

And that means: more fertilizer!

Subscribe to:

Posts (Atom)