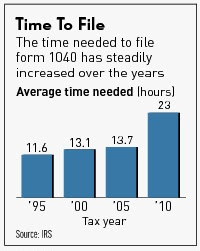

This year, it will take the average taxpayer 23 hours just to fill out Form 1040 — up from 21 hours last year, according to the IRS. It now takes 7 hours to fill out the so-called 1040 EZ.

Tax complexity isn't merely a hassle for taxpayers, it's a huge drag on the economy. It takes more than 6 billion hours — or $163 billion a year — for companies and individuals to figure out what they owe, the IRS says. And the Government Accountability Office estimates that the distortions and inefficiencies created by the complex tax code cause up to $733 billion in "dead weight losses." Together, these costs equal 6% of GDP.

The ornate tax code also makes compliance harder and cheating easier, contributing to what the IRS figures is more than $290 billion in unpaid taxes — effectively raising taxes that much more on everyone else.

To get a sense of just how mind-bogglingly complex the federal tax code is, consider:

• More than 80% of individuals hire someone or buy software to help file their taxes, though only 64% of filers owe them, according to the Tax Foundation. So millions of filers pay for help to learn that their tax liability is zero.

• About two-thirds of low-income filers pay to have their taxes done, the Tax Policy Center found.

• The tax code has at least 6 definitions of a child, more than a 12 different education-related tax breaks and at least 16 different kinds of tax-favored savings plans.

No comments:

Post a Comment