Case Study: Managing Taxation on Retirement Income Withdrawals

As a way to help minimize the income taxes one pays, consider the following hypothetical scenario.

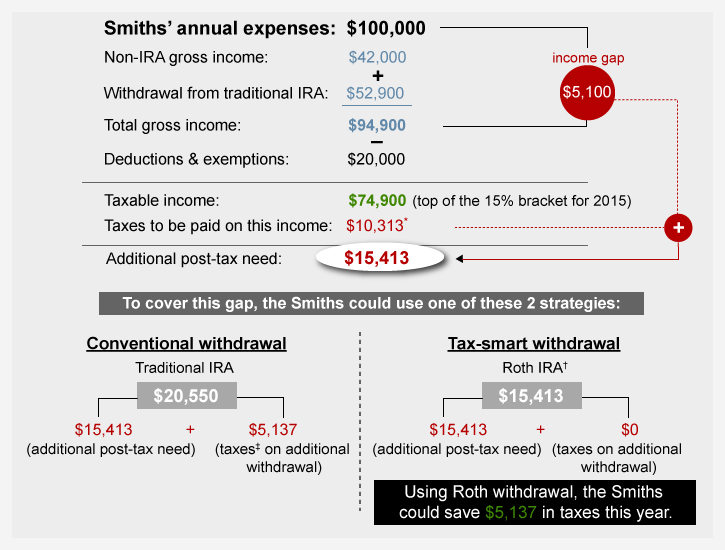

It illustrates the way a retired married couple whose annual expenses total $100,000 might seek to manage their taxes.

Our hypothetical couple expects $42,000 in gross income (all taxable) before tapping their retirement accounts, so their gross income gap—(before considering taxes)—is $58,000. They anticipate $20,000 in deductions and exemptions, so their expected taxable income before withdrawals is $22,000. If they withdraw $52,900 from their traditional IRAs, it would bring their taxable income to $74,900—the top of the 15% bracket for 2015.

They could then withdraw the remaining $5,100 that they need to cover their income gap from a Roth IRA, which does not generate taxable income (assuming the withdrawal is qualified). The chart below shows their cash flow and taxable income:

Example: How to Manage Taxes on Withdrawals for Retirement Accounts

This hypothetical example is for illustrative purposes only. This hypothetical scenario assumed the couple does not receive Social Security benefits. Social Security income would further complicate the tax scenario described above and should be considered when creating a withdrawal strategy.

Other Options for Our Hypothetical Couple

The hypothetical couple in this scenario leaves the bulk of Roth IRA assets alone, leaving them in place to potentially generate tax-free growth. In certain situations, however, it may be advantageous to tap Roth assets instead of tax-deferred or taxable accounts. These include situations when:

- Any distributions at all from a tax-deferred account would cause your taxable income to exceed your target marginal tax rate

- Withdrawing from a taxable account would require selling assets held less than a year, resulting in short-term capital gains, which are taxed at ordinary income tax rates

- You are also trying to minimize taxes on Social Security benefits, and withdrawals from a tax-deferred account would have an impact on the taxability of those benefits

Your circumstances may be considerably different from those described in the scenario. Nevertheless, you may be able to apply the principles to your own situation. A tax professional can help you explore the implications of different withdrawal strategies, help minimize the amount of taxes you pay on hard-earned savings, and, of course, help you maximize your ability to live the retirement you envision.

No comments:

Post a Comment