When you hear "Medicare Taxes," you probably don’t think about your investments.

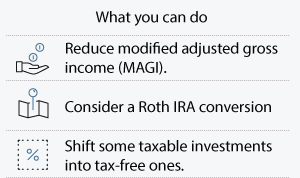

But these taxes affect many upper-income Americans with higher taxes on both wages and investment income. All the more reason to have a tax-smart financial plan in place.

There are TWO ways the Medicare Taxes affect upper-income people.

First, a 3.8% Medicare surtax is levied on the lesser of net investment income or the excess of modified adjusted gross income (MAGI) above $200,000 for individuals, $250,000 for couples filing jointly, and $125,000 for spouses filing separately.

Second, wages above $200,000 (individuals), $250,000 (joint filers), and $125,000 (spouses filing separately) will be subject to higher payroll taxes.

No comments:

Post a Comment