Pitfall to Avoid:

Transfer on Death (TOD) or Payable on Death (POD) Not Matching Wills

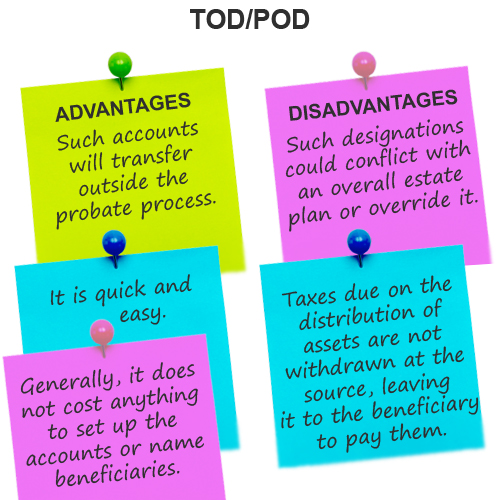

A simple and easy way to help avoid probate is to name someone as a transfer on death (TOD) beneficiary or a payable on death (POD) beneficiary. The terms are essentially the same but apply to slightly different accounts. A TOD/POD beneficiary can be named on financial accounts, such as bank savings or checking accounts and investment accounts, vehicle titles, and—in some states—real property.

Despite their simplicity, one major issue with TOD-/POD-titled assets is a lack of awareness or poor coordination with overall estate planning strategies. Some people might not realize that a TOD- or POD-titled asset overrides whatever is stated in a will. If a number of accounts are titled as TOD or POD, a will can be rendered largely ineffective, and assets may not be distributed as intended because the TOD/POD beneficiary designations don’t align with those established in the will.

Estate taxes may be due on TOD assets depending on, among other things, how the will is drafted. If there are tax issues, relying on TOD/POD beneficiary designations may not be enough, and a more complex estate plan may be needed.

https://www.fidelity.com/viewpoints/estate-planning-to-dos

https://www.fidelity.com/viewpoints/estate-planning-to-dos

No comments:

Post a Comment